Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

Asset Allocation Outlook

How to evolve your portfolio for the latest market conditions? Explore the latest monthly snapshot of Wellington Solutions’ asset class views.

Disquiet in quality: What happened and what now?

Quality has been lagging since 2021, with underperformance accelerating sharply in 2025. Where does this leave investors now?

Succession planning: lessons for investors from three sectors

Equity Portfolio Manager Yolanda Courtines and Investment Director Alex Davis explore the importance of CEO succession planning for investors through three sector case studies.

Oil: The real influencer in the Venezuela intervention

Multi-asset Strategist Nanette Abuhoff Jacobson details the role of oil in the recent events in Venezuela and shares the investment implications.

Geopolitics in 2026: Risks and opportunities we’re watching

Geopolitical Strategist Thomas Mucha shares his outlook, highlighting conflicts to watch, the importance of national security, and investment opportunities.

Financing the AI boom: credit markets at a crossroads

Fixed Income Portfolio Manager Derek Hynes and Fixed Income Investment Specialist Will Prentis examine how the AI financing boom is transforming credit markets and discuss the opportunities and risks it creates for investors.

The power of Asia’s dividends

Discover Asia’s quality dividend potential. With diverse income sources, structural tailwinds, and governance reforms at play, Asia offers a compelling mix of income, resilience, and long-term growth potential.

What does the new economic era mean for equities?

The twists and turns of 2025 have reinforced the sense that the global economy is undergoing a structural shift — towards higher inflation, more volatile business cycles and a potential gradual unwinding of decades-long globalisation. However, with flexibility and careful positioning, there are reasons to be positive about the outlook for global equities

Rapid Fire Questions with Ross Dilkes

In this edition of “Rapid Fire Questions,” fixed income portfolio manager Ross Dilkes shares his views on the Asia credit market—covering the macro outlook, China’s momentum, the most compelling opportunities across the region, and key risks shaping the next 12 months.

Rapid Fire Questions with Philip Brooks on Asian equities

In this edition of “Rapid Fire Questions,” Philip Brooks, investment director and equity strategist, answers key questions on Asian equities—exploring the structural drivers of the asset class, the traits of quality businesses, and the most compelling quality dividend opportunities today.

Is all that glitters still gold?

Gold has delivered impressive gains thus far in 2025, but what does that say about market risks and the recent strong returns of stocks? Multi-Asset Strategist Nanette Abuhoff Jacobson offers her take on the precious metal and the case for diversification in today’s market.

Questioning US credit quality

Fixed income strategist Amar Reganti examines questions surrounding US creditworthiness.

Chart in Focus: Is the Fed rate cut positive for risk?

In this edition of Chart in Focus, we examine how the Fed’s long-awaited interest rate cut may influence risk assets.

Japan's reflation story: An overlooked equity opportunity?

Macro Strategist Nick Wylenzek analyzes the structural shifts in Japan's economy and identifies potential equity opportunities.

Not all AI opportunities are created equal

Global Industry Analyst Michael Masdea explores AI's transformative power and shares a five-step framework to help evaluate potential long-term AI success stories.

Rapid Fire Questions with Alex Chambers

In this edition of “Rapid Fire Questions,” Director of Alternatives, Hedge Funds, APAC, Alex Chambers answers four key questions on the role and opportunities of hedge funds in today’s market.

Rotations and reallocations: Rethinking equities

Since April's Liberation Day, equity markets have recovered losses and appear to be on an upwards trajectory. But under the surface of the highs, argues Equity Strategist Andrew Heiskell, is a market and an economy looking for direction. Why is the economy so stuck?

False signals? A macro investing playbook

Portfolio Manager Arancha Cano shares her insights on interpreting potentially conflicting and unreliable data signals as investors navigate an increasingly uncertain market environment.

Chart in Focus: What do higher long-end yields mean?

Long-end yields have climbed on concerns over structural growth and fiscal expansion. In this edition of Chart in Focus, we explore how shifting yield curves are reshaping opportunities across asset classes.

The long-term rewards of a contrarian approach to European equities

Portfolio Manager Tom Horsey and Investment Director Thomas Kramer explain why viewing European equities through a contrarian lens could help investors to uncover long-term opportunities in a rapidly evolving Europe.

Chart in Focus: Fed rate cuts resume — What’s next for investors?

In this edition of Chart in Focus, we explore the Fed’s return to rate cuts after a strategic pause. We examine how this move, alongside diverging central banks paths, could shape the outlook for risk assets.

Rapid Fire Questions with Tim Manning

In this edition of “Rapid Fire Questions,” equity portfolio manager Tim Manning offers his views on rates, fiscal policy, tariffs, and AI — and shares why he remains constructive on the US equity market.

Growth vs stability: do infrastructure investors really have to pick a side?

There’s a buzz around infrastructure at the moment. But do listed infrastructure investors really have to invest in cyclical businesses in order to benefit from structural tailwinds? Tom Levering and Joy Perry explore another way.

How a changing Europe is reshaping credit markets

Portfolio Managers Derek Hynes and Konstantin Leidman explore how a changing Europe is reshaping the region's credit markets and identify key takeaways for investors.

Chart in Focus: Are today’s equity returns too high?

In this edition of Chart in Focus, we examine the strength of markets so far this year, placing it in historical context.

Five ways to find opportunity in a new world (dis)order

Geopolitical Strategist Thomas Mucha analyzes the investment implications of five global themes that speak to the need for strategic adaptation in a turbulent world.

Chart in Focus: Where are rates headed?

In this edition of Chart in Focus, we take a look at where rates have been headed and potential implications moving forward.

Chart in Focus: Earnings upgrades fueled the recent US equity market rally

Where are earnings heading? In this edition of Chart in Focus, we address the recent uptick in earnings expectations and its potential impact on equity returns.

Twilight zone: how to interpret today’s uncertain macro picture

Macro Strategist John Butler and Investment Director Marco Giordano explore how to interpret today’s uncertain macroeconomic picture and its key implications.

Chart in Focus: Are higher valuations justified?

Since Liberation Day, a clearer picture on tariffs has begun to emerge and markets have rallied in response. In this edition of Chart in Focus, we revisit cross-asset valuations and examine if the higher valuations are justified.

(Re)emerging markets: 10 reasons for optimism

Our experts identify 10 reasons why now may be the time for investors to reconsider emerging markets.

China’s changing: Why you should be watching

Macro Strategist Johnny Yu discusses structural shifts in China impacting global investment dynamics. notably diminished importance of the property sector and collapse of imports.

Chart in Focus: Is growth investing still dominating?

Growth isn't global? In this edition of Chart in Focus, we compare the performance of value vs. growth stocks globally, highlighting the contrast by region, and in turn explore the implications for style investing.

Rapid Fire Questions with Philip Brooks (Part 2)

In part 2 of his “Rapid Fire Questions”, equity strategist Philip Brooks shares his views on 3 key questions, focusing on the topic of Quality and investible opportunities today in US and abroad.

AI isn’t like other tech cycles — and investors may need a new approach

AI may dominate headlines and strategy decks but people may still be underestimating its potential for disruption. What makes AI so different to other tech cycles?

Rapid Fire Questions with Philip Brooks (Part 1)

In part 1 of his “Rapid Fire Questions”, equity strategist Philip Brooks shares his views on 3 key questions, focusing on market outlook and risks.

Chart in Focus: Did you miss out on the market bounce back in April?

Did you miss out on the market bounce back in April? In this edition of Chart in Focus, we look at market turnaround following the Liberation Day correction, highlighting the consequences of not having stayed invested.

Where’s my safe haven? A global investor perspective on the tariff tantrum

Portfolio Manager Martin Harvey shares his insights on how global investors may need to reassess long-held assumptions in light of shifting global dynamics.

Rapid Fire Questions with Campe Goodman

In this edition of “Rapid Fire Questions”, fixed income portfolio manager Campe Goodman shares his views on 4 key questions in this Q&A session.

Europe: a good hunting ground for high yield?

With attractive yields and a low duration profile, high yield can present potentially compelling opportunities for investors, despite the continued volatility.

Credit: the power of flexibility in an uncertain world

Uncertainty in credit markets can create opportunities for investors, provided allocations are flexible enough to benefit. But how can investors balance flexibility with discipline?

Making the most of the new economic era’s bright spots

Despite uncertainty, there are important factors supporting a more optimistic approach. By focusing on structural trends and considering a wide range of views, investors can position portfolios for positive long-term returns.

Four investment perspectives on Trump’s first 100 days

Four of our experts across fixed income and equity share their asset-class level insights on the first 100 days of the current Trump administration and analyze the implications for investors.

Chart in Focus: Patience is power — stay invested through volatility

What does a higher VIX mean? In this edition of Chart in Focus, we explore the historic performance of the global equity market after large bouts of volatility, and the investment implications for equity and fixed income investors amid the US tariff turmoil.

Fiscal versus tariffs: what wins out for Europe?

Just as investors were starting to explore the potential for growth in Europe, Trump’s tariffs landed. To what extent is the case for Europe still intact?

There is more than one way to approach growth equities

Portfolio Managers Steven Angeli and Joe Chung, and Investment Specialist Casey Vale discuss how looking at growth equities in a different way may help uncover opportunities amid heightened uncertainty and volatility.

What do tariffs mean for portfolios?

Tariffs exceeded market expectations. Now what? Expect short-term volatility, identify concentrations and consider using sell-offs as an entry point to diversify across regions and styles, says Nanette Abuhoff Jacobson, Global Investment and Multi-Asset Strategist.

The changing face of Europe: regime change gathers pace

Macro Strategist Nicolas Wylenzek explores the drivers of Europe’s accelerating regime change and its impact on European equity markets and potential areas of opportunity.

How stewardship can bring perspective amid uncertainty

Portfolio Managers Yolanda Courtines, Sam Cox, Investment Director Alex Davis and Investment Specialist Fred Owens-Powell examine how a stewardship perspective can help equity investors uncover opportunity amid uncertainty.

The power of local perspective: the rewards of a contrarian approach to European equities

Portfolio Manager Tom Horsey and Investment Director Thomas Kramer explain why they see compelling opportunities in today's European equity market for contrarian, bottom-up investors.

Power play: Building the case for infrastructure in 2025

The long-term case for listed infrastructure remains compelling. But could near-term catalysts, such as nuclear and natural gas, also drive performance in the short term?

Chart in Focus: Can quality hedge against inflation?

Can Quality hedge against inflation? In this latest edition of Chart in Focus, we explore the historic outperformance of high-quality stocks and bonds during periods of high inflation, perhaps offering lessons should inflation surprise to the upside in 2025.

Time for credit selection to shine

Fixed income investors continue to seek answers to an era of volatile rates. Large, static exposures to credit markets no longer cut it. Instead, a nimble and dynamic approach is more likely to create resilient and consistent total return outcomes.

Emerging markets under Trump 2.0: expect the unexpected

Portfolio Manager Dáire Dunne and Investment Director Irmak Surenkok discuss what Trump 2.0 entails for emerging markets investors and what useful lessons they can learn from his first term.

High-yield bond investing in 2025: the year of the coupon

High-yield bond Portfolio Managers Konstantin Leidman and Mike Barry, and Investment Director Jennifer Martin discuss why, in 2025, high-yield bond investing is all about the coupon.

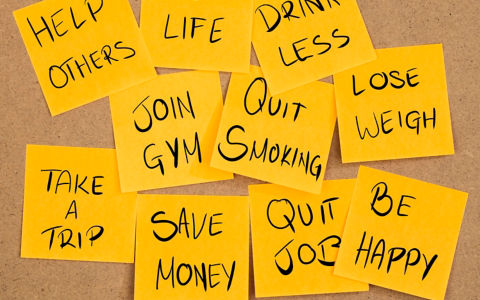

Four achievable New Year’s resolutions for investors

Are New Year’s Resolutions for investors purely aspirational or a helpful tool? Investment Strategy Analyst Alex King believes the latter and proposes four achievable resolutions.

High-yield credit investing: it’s a marathon, not a sprint

Fixed Income Portfolio Manager Konstantin Leidman explains his focus on the high-quality companies likely to outperform over the long term and why he is wary of the hype surrounding potentially bubble-inducing developments like generative AI.

What's current in credit: November 2024

Connor Fitzgerald explores the impact of President Trump’s US election victory on credit markets. Where are the opportunities and risks for credit investors now?

Time for bond investors to take the wheel?

Volatility makes bond investing less straightforward, but it can also create opportunities, provided investors are in a position to "take the wheel" in order to capitalise on them.

What do declining European earnings mean for ECB policy?

European companies have been unexpectedly resilient over the last couple of years. However, the outlook for European earnings could be more challenging than headline numbers suggest. What could this mean for investors?

Are bond investors ready for a US industrial revolution?

Portfolio Manager Connor Fitzgerald discusses why bond investors should ready themselves for a potential US industrial revolution and shares his perspective on how to reposition portfolios for such a scenario.

The power of local perspective: the long and short of European equity investing

Dirk Enderlein and Boris Kergall explain why, in their view, the structural changes impacting European equity markets offer active long/short investors a rich source of potential return and diversification.

Quality growth — a less volatile sweet spot?

Growth stocks can be volatile, especially when companies fail to meet expectations. However, high-quality growth companies can help mitigate downside risk while still offering potential for long-term outperformance. How can investors find the sweet spot?

Unlocking the full value potential of stewardship

Yolanda Courtines and Alex Davis examine how corporate stewardship can be a source of value and delve into what investors can do practically to maximise its full potential.

Japan’s factory automation sector: Poised for a significant upturn?

Global Industry Analyst Takuma Kamimura explains why he believes we’re on the verge of a multiyear cyclical upturn in the factory automation sector and why he sees a compelling outlook for select Japanese companies in particular.

US election special: which investment themes win at the polls?

The upcoming US election could be one of the most momentous in recent history. How could the result affect different investment themes? Our thematic team investigate the potential implications for investors.

Unearthing the unseen in geopolitics

Unearthing the unseen in geopolitics. Watch Geopolitical Strategist Thomas Mucha delve into the investment impact of structural geopolitical shifts and share his latest take on the upcoming US election.

An active investor’s guide to growth equities

Our experts offer their view on the current economic environment, explore best practices for investing in high-quality growth equities, and highlight where they see opportunity now.

Chart in Focus: The need to differentiate market growth from macro growth

Macro growth and earnings growth have been misaligned for the last 15 years, particularly in the US and China, but in opposite directions. For equity investors, what would be the key to identify real growth?

The US elections through the eyes of a European investor

Supriya Menon, Head of Multi-Asset Strategy – EMEA, explores what potentially material implications upcoming US elections could have for European investors and identifies key areas to monitor closely.

Four investment perspectives amid a pivotal US election

How can investors reposition portfolios for a pivotal but highly unpredictable US elections? Nick Samouilhan explores potential avenues in conversation with three leading portfolio managers.

The investment implications of Europe’s ageing workforce

What are the investment implications of Europe’s ageing workforce? Macro Strategist Nicolas Wylenzek explores the drivers of this accelerating demographic shift, Europe’s likely response and the opportunities it creates for investors.

Destination diversification – is your bond portfolio ready to take flight?

In a new economic era, bonds once again provide the potential for downside protection, but diversification within fixed income is increasingly important. Impact bonds can offer a differentiated and diversified way to drive both positive change and returns.

Time to capitalise on the evolving role of bonds?

We outline why we think the new economic era is elevating the role of bonds as a source of attractive and stable income, downside protection and portfolio diversification.

Opportunities in high yield: ready, steady, pounce?

Fixed income investors face a fundamentally different environment, but opportunities to target growth in high yield are emerging, provided investors can stay on the front foot.

Diving into the new world of credit

Now that spreads have tightened, some investors think it's too late to invest in credit. But this assumption could be standing in the way of earning an attractive income.

Japan’s tech sector: Time for a reboot?

Japan's semiconductor industry has revived global interest in Japan's tech ecosystem. But we believe the dynamism of Japan's tech sector today doesn't start and end with electronics and semiconductors.

The power of local perspective: where next for European banks?

Global Industry Analyst Thibault Nardin explores how monetary policy divergence, technological disruption and sector consolidation are reshaping European banks, while creating potentially compelling opportunities for active investors.

Chart in Focus: Four key areas of opportunities in bonds amid Fed uncertainty

We discuss four key areas of opportunities in fixed income amid Fed uncertainty in the second half of the year.

Breaking concentration: big picture thinking with small-cap equities

How to overcome the risks associated with today's concentrated market? Investment Director John Mullins explores why small-cap equities could be part of the answer.

Surprise French election result: what does it mean for investors?

Macro Strategist Nick Wylenzek and Investment Director Thomas Kramer discuss the surprise French election and its implications for European equities.

URL References

Related Insights

Markets in 2025: asleep at the wheel or in the driving seat?

Watch the conversation with Head of Macro Strategy John Butler as he discusses recent macro events and potential 2025 market outcomes for investors.

By