Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

Succession planning: lessons for investors from three sectors

Equity Portfolio Manager Yolanda Courtines and Investment Director Alex Davis explore the importance of CEO succession planning for investors through three sector case studies.

Transition at risk: Checking in on corporate decarbonization progress

Corporate climate transitions face ambition-execution gaps. Success requires integrating decarbonization into business strategy, focusing on emissions, pragmatic Scope 3 approaches, transparency, and credible plans. See how our experts are thinking about this.

Evaluating human capital management amid AI adoption: A guide for investors

This guide explores the critical role of HCM in maximizing AI's potential benefits, from productivity to innovation. Wellington ESG analyst Caroline Conway also provides targeted engagement questions to ask management teams as they navigate their AI journey.

2024 Sustainability Report

We appreciate the opportunity to share our approach to advancing sustainable practices across our investment, client, and infrastructure platforms.

How stewardship can bring perspective amid uncertainty

Portfolio Managers Yolanda Courtines, Sam Cox, Investment Director Alex Davis and Investment Specialist Fred Owens-Powell examine how a stewardship perspective can help equity investors uncover opportunity amid uncertainty.

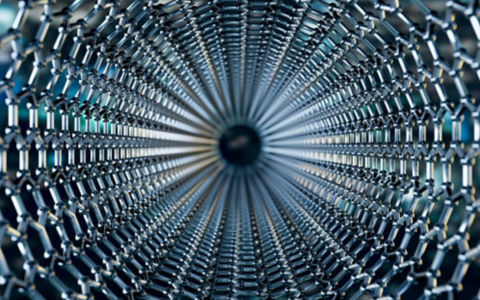

Navigating AI resource demands: Strategies for sustainable data center operations

AI's growing computational demands are raising critical questions about energy efficiency and water-resource management. We delve into strategies for enhancing sustainable data center operations, highlighting the importance of proactive resource stewardship.

Assessing the impact of climate resilience

Oyin Oduya and Louisa Boltz discuss the case for impact solutions focused on climate adaptation and share high-level guidelines to help overcome the associated measurement challenge.

Will proposed corporate governance reforms help to narrow the “Korea discount”?

Could South Korea's Corporate Value-up Program help to narrow the so-called “Korea discount” and build on the momentum gathering pace elsewhere across Asia to improve corporate governance and shareholder returns?

URL References

Related Insights