-

Sector:Biotechnology

Acrivon Therapeutics

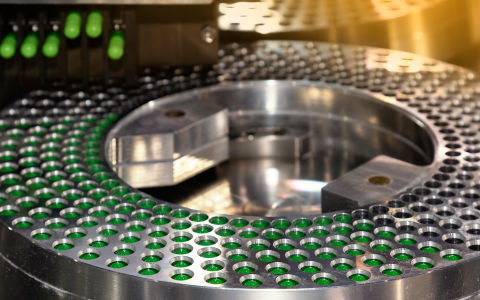

Acrivon Therapeutics Inc is a clinical-stage biopharmaceutical company developing oncology medicines that the Company matches to patients whose tumors are predicted to be sensitive to each specific medicine by utilizing its proteomics-based patient responder identification platform.