- Head of Multi-Asset Strategy – Insurance

Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

The views expressed are those of the author at the time of writing. Other teams may hold different views and make different investment decisions. The value of your investment may become worth more or less than at the time of original investment. While any third-party data used is considered reliable, its accuracy is not guaranteed. For professional, institutional, or accredited investors only.

Is that light at the proverbial end of the long tunnel that was 2020 – 2021? At least from an investment standpoint, it’s starting to feel that way for many of our insurance clients — not that 2021 has been without major challenges and volatility, or that 2022 doesn’t pose continued risks (including the fast-spreading Omicron variant of COVID-19), but there seems to be a sense of cautious optimism heading into the new year that’s been missing since early 2020.

The COVID-19 crisis has galvanized the global insurance industry in many ways and has forced insurers to reassess all aspects of their business. We have observed a noticeable uptick in insurer requests for strategic asset allocation studies, a spike in demand for actionable ideas to advance ESG integration broadly, and a growing desire to address climate-related risks and opportunities specifically. We have also seen insurers focus on all flavors of risk capital, both regulatory and rating agency-driven, with the goal of optimizing their portfolios accordingly. Finally, the industry is dusting off its inflation protection blueprints to prepare for the mounting threat of higher inflation in the period ahead.

Thus, our 2022 outlook for global insurers is framed around the three key themes of: 1) inflation; 2) capital; and 3) ESG, taking into account that these topics do not neatly lend themselves to “one-size-fits-all” solutions because no two insurers are exactly alike.

For all the economic crises experienced over the past three decades, it’s safe to say that concerns about runaway inflation haven’t characterized any of them. From 1990 through 2020, the average annual rate of change in the US Consumer Price Index (CPI) was 2.4%, a far cry from the 7% run rate of the 1970s or the nearly 6% levels of the 1980s. Fast forward to 2021: Per the US Bureau of Labor Statistics, the 12-month change for the CPI was 6.2% as of 31 October (not seasonally adjusted), with inflation fears continuing to climb as the likelihood of inflation being just a “transitory” phenomenon (as opposed to a more “persistent” one) begins to wane.

The inflation story to date has largely been predicated on backed-up global supply chains that have coincided with rising consumer demand for goods and services (as much of the developed world reopened from COVID), coupled with a reduced labor pool that is driving wages up. Consumers have increasingly felt the pain of higher prices in recent months — and it may not get better anytime soon. In particular, elevated CPI components like rent may be indicators of inflation taking hold for the longer term and not being a mere “blip” on the screen. Insurers, with their often significant exposure to fixed income assets, along with liabilities that can grow as costs rise, now need to take stock of what this new inflationary paradigm could mean for their industry. Many have begun to do so, while looking for investment strategies that can help alleviate inflation’s potentially negative impacts on their business.

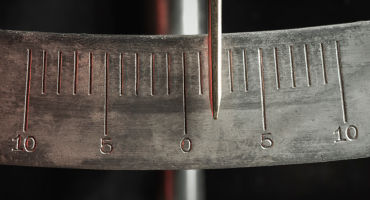

Given how much time has passed since inflation was front and center, our multi-asset team ran a regression analysis of different asset classes in which insurers have historically invested, going back to the early 1970s (Figure 1). This analysis shows the beta (correlation) of each asset class to the CPI, while holding real growth constant over the time period used. Directionally, the results are intuitive and likely what you would have expected. However, the relative betas for each asset class, particularly for lower-volatility insurance reserve assets, clearly demonstrate the need for most insurers to have some level of inflation protection in their investment portfolios.

What about asset classes that may stand to benefit from rising inflation? While natural resources equities and commodities, for example, may indeed be poised for strong performance in the next few years if inflation persists, these assets present other investment considerations for…

To read more, please click the download link below.

Breaking concentration: big picture thinking with small-cap equities

Continue readingURL References

Related Insights

Stay up to date with the latest market insights and our point of view.

Weekly Market Update

What do you need to know about the markets this week? Tune in to Paul Skinner's weekly market update for the lowdown on where the markets are and what investors should keep their eye on this week.

Breaking concentration: big picture thinking with small-cap equities

How to overcome the risks associated with today's concentrated market? Investment Director John Mullins explores why small-cap equities could be part of the answer.

Ideas for navigating a new era

Explore our latest views on risks and opportunities across the global capital markets.

Managing currency exposure in multi-asset portfolios: how to weigh the trade-offs and impact

Nick Samouilhan, Head of Multi-Asset Strategy – APAC, evaluates the trade-offs of different currency hedging approaches and offers a novel framework for gauging their potential portfolio impact.

Top of Mind: The allocator’s checklist for 2024 and beyond

Head of Multi-Asset Strategy Adam Berger offers near- and longer-term ideas for allocators, including thoughts on areas where capital is scarce, alternatives may be attractive, and risks may bear watching.

The growing importance of supply chain transparency

Head of Sustainable Investment Wendy Cromwell explains why supply chains remain a key investment risk and details related research areas for our SI team in 2024.

Income investing in multi-asset portfolios: Tipping the balance in your favour

Income can play a crucial role in the pursuit of investment objectives over time, but research from our iStrat Team argues for a balanced approach to asset allocation decisions given the potential trade-offs between income and capital return, risk, and portfolio diversification.

Core fixed income: Stop me if you’ve heard this one before

Head of Multi-Asset Strategy – Insurance and Portfolio Manager Tim Antonelli updates insurers on the status of the market today, shares what he believes they can expect for the rest of the year, and identifies areas that may be worth a closer look.

How will asset prices be affected by climate risk? Members of our Investment Strategy team explain how they're seeking to answer that question with their new climate-aware capital market assumptions.

Investors seeking a sound decumulation strategy must consider a host of variables, including risks that weren't on the radar when they were accumulating assets.

The tense Ukraine crisis has brought the US-Russia standoff to a head: Now what? Geopolitical Strategist Thomas Mucha argues this is all part of a global geopolitical pattern — “great-power” competition — that makes the Russian threat particularly dangerous.

URL References

Related Insights