Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

2024 Climate Report

Aligned with TCFD recommendations, this report describes how we manage climate-related risks and opportunities, engage with companies on climate change, and reduce our own carbon footprint.

2024 Sustainability Report

We appreciate the opportunity to share our approach to advancing sustainable practices across our investment, client, and infrastructure platforms.

Measuring impact in venture capital

We highlight why venture capital matters to impact investors and how to authentically measure and manage impact in this asset class.

Impact measurement and management: addressing key challenges

Our IMM practice leader describes common impact investing challenges and suggests ways to overcome them.

Decoding impact expectations: best practices for impact investors and companies

We share three recommendations each for impact investors and companies to help them better understand and manage each other's expectations.

Impact measurement and management practices

What constitutes an impact investment? How is impact measured? And, what are the benefits of impact investing? Our Impact Management and Measurement Practice Leader Oyin Oduya discusses our approach.

Assessing the impact of climate resilience

Oyin Oduya and Louisa Boltz discuss the case for impact solutions focused on climate adaptation and share high-level guidelines to help overcome the associated measurement challenge.

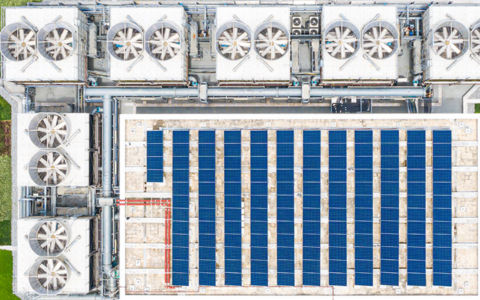

Commodities and the energy transition: Symbiosis for the future

The global energy transition is driving demand for commodities. Our experts explain which ones will be needed most.

Will proposed corporate governance reforms help to narrow the “Korea discount”?

Could South Korea's Corporate Value-up Program help to narrow the so-called “Korea discount” and build on the momentum gathering pace elsewhere across Asia to improve corporate governance and shareholder returns?

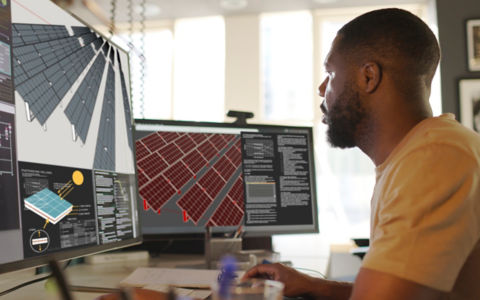

Why climate change matters in private markets

We explore why climate change matters in private markets, highlight the current regulatory landscape, and profile key questions to expect from public market investors.

Toward carbon neutrality: Our approach to carbon offsets

Wellington has committed to be carbon neutral in our operations by the end of 2022. Members of our Sustainable Investing and Corporate Sustainability Teams describe our multifaceted approach to achieving that goal.

URL References

Related Insights