Skip to main content

- Funds

- Capabilities

- Sustainability

- Insights

- About Us

- My Account

Investment Solutions

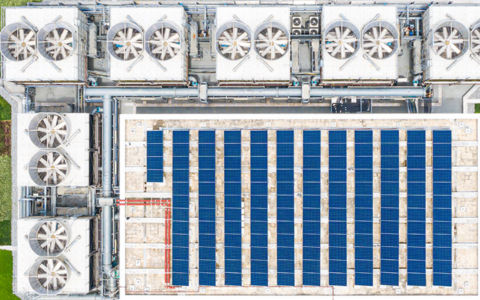

Sustainable Investing

Stewardship Principles

Investment Solutions

Funds

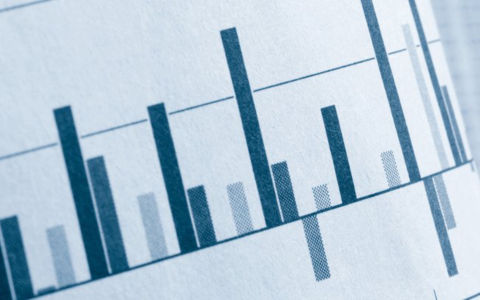

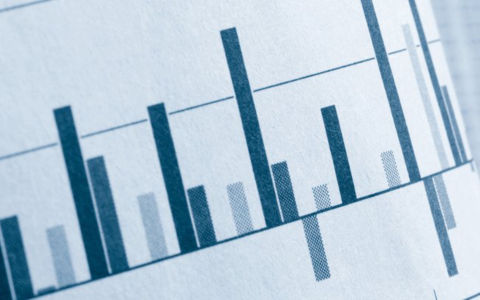

Quarterly Market Review — 4Q2025

A monthly update on equity, fixed income, currency, and commodity markets.

By