- Fixed Income Portfolio Manager

Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

The views expressed are those of the author at the time of writing. Other teams may hold different views and make different investment decisions. The value of your investment may become worth more or less than at the time of original investment. While any third-party data used is considered reliable, its accuracy is not guaranteed. For professional, institutional, or accredited investors only.

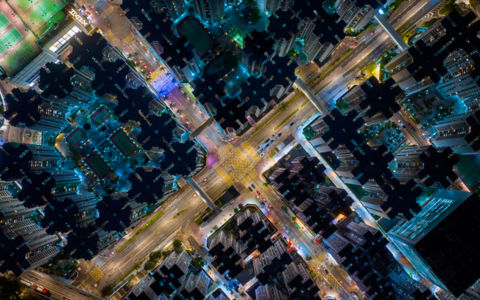

First caught in the crosshairs of the COVID-19 crisis, then roiled by the Russia/Ukraine conflict and the onset of global monetary tightening, emerging markets (EMs) have experienced their share of challenges and volatility over the past few years. Despite the recent turmoil (or in some cases, because of it), we think now is an interesting and opportune time to consider investing in emerging local debt (ELD) markets. As we survey today’s ELD landscape, we see potentially positive trends across fundamentals, valuations, and technicals that we believe are likely to be supportive of these markets going forward.

ELD markets have two primary sources of investment returns: interest rates and currencies. Let’s look at both and how they factor into our current outlook for these markets.

At the asset class level, our views on the fundamental, valuation, and technical outlooks for ELD markets are generally positive. The market headwinds posed by today’s geopolitical and macroeconomic risks, while potentially formidable, do not by themselves detract from our conviction that some investors may benefit from having some portfolio exposure to both EM interest rates and currencies.

1Sources: JPMorgan, EM central banks, Wellington Management. | 2Source: JPMorgan.

Top 5 fixed income ideas for insurers in 2026: Give ground on risk, but just a little

Continue reading2026 Insurance Outlook: Cautious optimism and a second bite at the apple

Continue readingAnother banner year for emerging markets local debt in 2026?

Continue readingAn active management partner for the near and long term

Continue readingURL References

Related Insights

Top 5 fixed income ideas for insurers in 2026: Give ground on risk, but just a little

With a note of cautious optimism, we consider a range of fixed income ideas for insurers, from investment-grade private credit to emerging market debt.

2026 Insurance Outlook: Cautious optimism and a second bite at the apple

Members of our Insurance team share their economic expectations, investment ideas, and a regulatory roundup for the year ahead.

Another banner year for emerging markets local debt in 2026?

Our experts highlight EM local debt's strong 2025 performance and explain their bullish outlook for 2026.

Top 5 fixed income ideas for 2026

Which areas in fixed income offer the most promising potential in 2026? Fixed Income Strategist Amar Reganti and Investment Communications Manager Adam Norman share their annual top five ideas.

Monthly Market Review — December 2025

A monthly update on equity, fixed income, currency, and commodity markets.

Weekly Market Update

What do you need to know about the markets this week? Tune in to Paul Skinner's weekly market update for the lowdown on where the markets are and what investors should keep their eye on this week.

An active management partner for the near and long term

CEO Jean Hynes focuses on key themes driving our evolving capabilities and client collaboration, including AI's transformative potential and new thinking about equity, fixed income, and alternative allocations.

Opportunity ahead: Optimism or illusion?

Explore our latest views on risks and opportunities across global capital markets.

The spending bubble driving corporate profits looks set to burst

US corporate profits have been fueled by government deficits, low rates, and consumption — drivers now at risk, raising questions about the sustainability of market valuations.

FOMC: Easing into uncertainty

Fixed Income Portfolio Manager Jeremy Forster profiles the Fed's December rate cut, labor market trends, inflation pressures, and the role of anticipated changes to FOMC leaders in 2026.

Financing the AI boom: credit markets at a crossroads

Fixed Income Portfolio Manager Derek Hynes and Fixed Income Investment Specialist Will Prentis examine how the AI financing boom is transforming credit markets and discuss the opportunities and risks it creates for investors.

URL References

Related Insights

Monthly Market Review — December 2025

Continue readingBy