This mismatch between global fundamentals and locally anchored investment perspectives creates persistent inefficiencies. To understand global fundamentals within the health care space, we believe investors may do well to leverage scientific insight, stay abreast of international therapeutic trends, and monitor competition in key markets, such as the US and Europe. This approach could help investors identify the mispricing opportunities domestic-focused capital may overlook.

Stabilizing backdrop creates selective opportunity

Pricing debates, policy uncertainty, and post-pandemic normalization have driven a period of adjustment in global health care. Japanese biopharma has moved through this phase, too. However, as this adjustment phase matures, conditions have begun to stabilize, with improved visibility on policy, earnings, and capital allocation. Against this backdrop, valuations remain measured rather than exuberant, even as the operating environment becomes more predictable.

What’s more, the health care sector — particularly pharmaceuticals and biotechnology — offers substantial scope for alpha generation. In these industries, the success of a limited number of differentiated products can meaningfully reshape earnings trajectories and equity valuations. This dynamic creates significant dispersion across companies and assets. For investors able to apply differentiated scientific insight and a global investment lens to assess clinical relevance, competitive positioning, and unmet medical need, the opportunity to identify mispriced winners is particularly compelling.

When global outcomes matter more than local execution

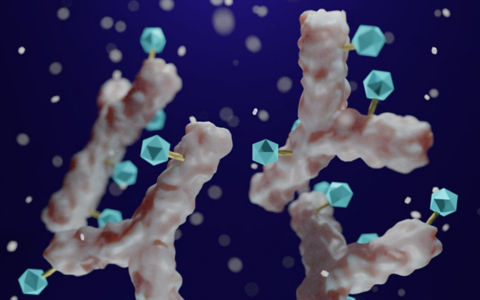

In some cases, a significant portion of future earnings is linked to royalty income from globally successful drugs. In these scenarios, commercial outcomes are determined almost entirely outside Japan.

One example involves a Japanese pharmaceutical company that receives royalties tied to the global rollout of a leading obesity and diabetes therapy developed by a major US pharmaceutical company. As this treatment scales rapidly across international markets, royalty income is expected to become an increasingly important and stable profit contributor.

Therefore, rather than a narrow focus on domestic operations, evaluating this business requires a global view of manufacturing capacity expansion, competitive positioning within the obesity treatment market, pricing dynamics, and long-term penetration.

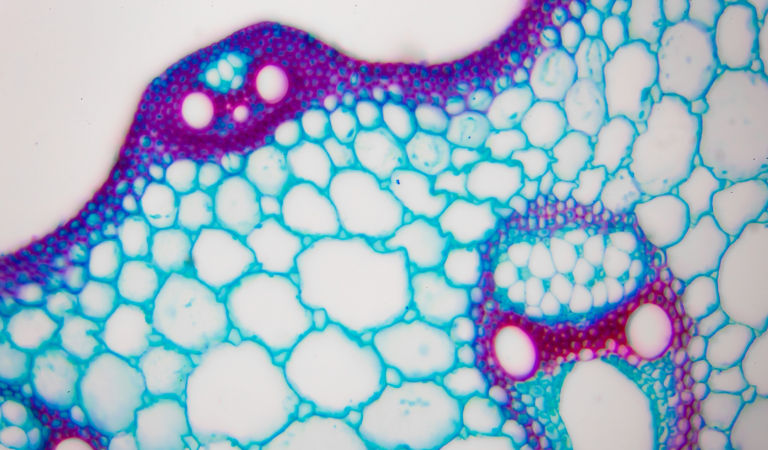

Scientific insight and global perspective on underappreciated pipelines

Other opportunities can be found where markets struggle to assess complex pipelines through a global lens, creating alpha for active managers who apply differentiated scientific insight to identify the most compelling assets.

A notable example can be found in a long-established Japanese pharmaceutical company that has been actively strengthening its pharmaceutical pipeline. While the company’s evolution and investment in late-stage and next-generation assets may be underappreciated by local investors, the opportunity becomes clearer when viewed through a global lens informed by scientific evidence and evolving treatment standards. By rigorously assessing pipeline differentiation, clinical relevance, and unmet medical need — rather than relying on legacy perceptions — active managers can uncover mispriced opportunities that the domestic market may overlook.

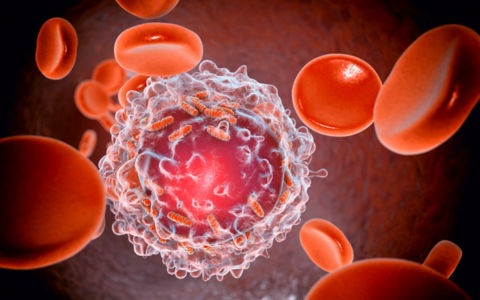

New treatment paradigms creating asymmetry

Additional opportunities can be found in companies poised to benefit from shifts in global treatment paradigms. We’re witnessing a period of transformation in drug development and delivery. For example, consider a Japanese pharmaceutical company focused on originating differentiated therapies within a major therapeutic area, HIV treatment. It has started transitioning historically daily oral medications for chronic HIV management to long-acting injectables — something their competitors have struggled to execute.

This isn’t just a product upgrade; it’s a fundamental shift in the way HIV therapies are delivered that impacts patient convenience, adherence, and market size. Changes at this scale often create valuation disconnects because they alter competitive dynamics and revenue models in ways that markets may not readily price in. Yet the market continues to value the business as if the shift won’t translate into meaningful upside. Such miscalculations represent significant opportunities for active managers, especially those with scientific acumen and deep wells of research to understand just how revolutionary transformations like this could be.

The value of a local and global perspective

Prudent Japanese biopharma investors need to understand local market dynamics, corporate governance, and capital discipline, and maintain a global health care perspective. Outcomes for many Japanese companies are increasingly determined by global innovation cycles, competitive positioning, pricing dynamics, and capital allocation decisions made outside Japan.

This suggests a widening gap between where value is created and how it is priced. In Japan, many companies with globally driven earnings continue to be analyzed through a domestic lens, leading to persistent mispricing. Capturing these opportunities requires the ability to integrate scientific understanding, global industry insight, and local market expertise. This is difficult to achieve through passive exposure or purely domestic analysis and suggests a strong case for active management.

In a sector where sentiment remains cautious and valuations are restrained, it’s precisely this combination of local and global perspectives that can turn complexity into an edge for uncovering differentiated sources of return.