-

-

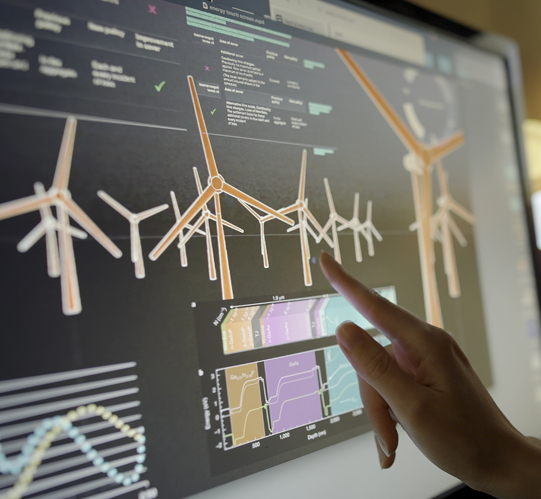

Solution scope and design

-

Our team works with clients to define their risk and return goals and to incorporate specific constraints like volatility, liquidity, and downside sensitivity.

-

Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

Our Funds

Fund Documents

Global Multi-Strategy Fund