- Director of Alternatives, Hedge Funds, APAC

Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

United States, Institutional

Changechevron_rightThank you for your registration

You will shortly receive an email with your unique link to our preference center.

The views expressed are those of the speaker at the time of filming. Other teams may hold different views and make different investment decisions. The value of your investment may become worth more or less than at the time of original investment. While any third-party data used is considered reliable, its accuracy is not guaranteed. For professional, institutional, or accredited investors only.

In this edition of “Rapid Fire Questions,” Director of Alternatives, Hedge Funds, APAC, Alex Chambers explores the role and opportunities of hedge funds in today’s market.

Question: What is your take on the role of hedge funds amid today’s market backdrop?

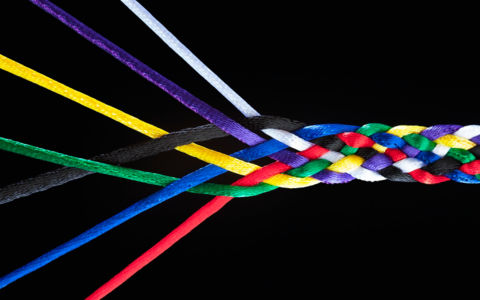

Diversification today remains the number one reason in our view for considering a hedge fund. Although there are a wide range of hedge fund strategies out there in all shapes and sizes, this continues to be the primary benefit for considering an allocation to the asset class. Hedge funds play an important role, being one of the very few liquid alternatives out there, and also typically uncorrelated to both global equities and global fixed income. As such, they can be complimentary and diversifying. Over the past few years, we have witnessed some compelling reminders of this potential value of a hedge fund as equities and fixed income have grown increasingly positively correlated. For example, we only have to look back to 2022, when diversification was lacking in traditional assets with both equities and fixed income broadly selling off. Today, that relationship still remains intact. And in an environment marked by elevated volatility and lingering geopolitical and inflationary concerns, we continue to see the benefit of adding a hedge fund as an additional layer of diversification.

Question: Why consider hedge funds now?

Over the past few years, we have witnessed a much-improved environment for hedge funds and this is starting to show in the recent performance in general, something we have not seen since pre-global financial crisis. Unlike the 2010s, we are now in a very different economic regime, with structurally higher inflation, a tricky monetary policy balancing act and more active government involvement through increased fiscal and industrial policy. This is all leading to higher interest rates, more volatile markets and increased dispersion – market factors that have been historically favorable for hedge funds.

Question: What approaches can we take to capture the opportunities?

With such an improving backdrop for hedge funds in general, we believe that a core allocation to a multi-strategy hedge fund can be a suitable solution to take advantage of the opportunities across various hedge fund strategies. Such an approach can allocate in a diversified and balanced way. Importantly, with a strong emphasis on alpha generation rather than market beta, hence potentially providing an uncorrelated stream of returns to equities and bonds.

Alongside this, in particular today, we are seeing a wide range of exciting opportunities across equity long/short strategies, a space where we have extensive experience going back over three decades. For example, within sectors there may be more acute dispersion in those areas undergoing rapid transformation such as energy, financials and technology. Take for instance in US financials where we are seeing regulatory restrictions easing potentially creating a new wave of M&A activity.

Elsewhere, we are also seeing regional opportunities with higher dispersion driven by a new regime of structural shifts. Take a diverse region like Europe where political and economic issues will vary greatly across countries and as a result will impact sectors and countries in distinct and differing ways.

Question: What are the risks we should watch out for when investing in hedge funds?

When investing in hedge funds, alongside the various benefits, there are also important considerations for allocators as well. Today, there are many hedge funds out there in all shapes and sizes, so manager selection is very critical. Many factors around transparency, liquidity, leverage and fees are all common considerations and should be areas of focus we believe when selecting a hedge fund. Today, for example, we hear a lot from allocators talking about the concerns around the amount of leverage in the system, and potentially crowding effects in certain themes and trades, which are concerns in the industry today.

Public REITs at a turning point: Value, growth, and diversification potential

Continue readingMore from the core: How fundamental extension (140/40) strategies could help

Continue readingMultiple authors

An active management partner for the near and long term

Continue readingTop of Mind: The allocator’s checklist for 2026 and beyond

Continue readingInflation, volatility, and valuations: 3 reasons hedge funds fit today’s market

Continue readingAre hedge funds the missing ingredient?

Continue readingLow tide, sharp eyes: What to pick up

Continue readingURL References

Related Insights

Get our latest market insights straight to your inbox.

Thank you for your registration

You will shortly receive an email with your unique link to our preference center

Public REITs at a turning point: Value, growth, and diversification potential

After several years of rate‑driven headwinds and post‑COVID earnings pressure, fundamentals are turning—and we believe the setup for public real estate today is one of the strongest in years.

More from the core: How fundamental extension (140/40) strategies could help

Extension strategies may offer investors more flexibility in portfolio construction, along with potential to achieve greater risk-adjusted returns, thus delivering “more from core” in equity allocations without taking on significantly more tracking risk.

Multiple authors

An active management partner for the near and long term

CEO Jean Hynes focuses on key themes driving our evolving capabilities and client collaboration, including AI's transformative potential and new thinking about equity, fixed income, and alternative allocations.

Top of Mind: The allocator’s checklist for 2026 and beyond

Multi-Asset Strategist Adam Berger offers near- and longer-term ideas for allocators, including thoughts on alternatives, potential market surprises, and risk management.

Inflation, volatility, and valuations: 3 reasons hedge funds fit today’s market

Our multi-asset strategists explain why economic and market conditions in the year ahead could make a compelling case for adding hedge funds to the asset allocation mix, including multi-strategy and equity long/short hedge funds.

Are hedge funds the missing ingredient?

Inflation, volatility, and valuations — they all raise questions about portfolio diversification and resilience. Multi-Asset Strategists Nanette Abuhoff Jacobson and Adam Berger explain why multi-strategy and equity long/short hedge funds could provide the answers. They offer insights on adding allocations to a traditional portfolio mix and a recipe for manager selection.

Low tide, sharp eyes: What to pick up

Fixed Income Managers Campe Goodman and Rob Burn share their outlook for credit in 2026 and discuss how investors can reposition for an environment where opportunities are harder to find.

Finding durable value amid shifting currents

Fixed Income Strategist Amar Reganti and Investment Director Marco Giordano explore how to approach bond investing in 2026. They see durable value for investors who can flexibly adjust to the shifting currents ahead.

Investing in 2026: prepare for inflationary growth

Macro Strategists John Butler and Eoin O'Callaghan share their annual macro outlook and discuss likely implications for markets and investors. They outline four potential scenarios graded by level of probability.

Time to diversify your diversifiers with hedge funds?

Christopher Perret highlights potential benefits of adding uncorrelated strategies, such as hedge funds, to portfolios to navigate turbulent markets.

Allocating to alternatives: A role-based guide for corporate DB plans

For corporate plan sponsors thinking about weaving hedge funds and private equity into their portfolios, we offer this brief guide to the potential benefits and key considerations when establishing an allocation, including liquidity stress testing.

Multiple authors

URL References

Related Insights

© Copyright 2026 Wellington Management Company LLP. All rights reserved. WELLINGTON MANAGEMENT ® is a registered service mark of Wellington Group Holdings LLP. For institutional or professional investors only.

Enjoying this content?

Get similar insights delivered straight to your inbox. Simply choose what you’re interested in and we’ll bring you our best research and market perspectives.

Thank you for joining our email preference center.

You’ll soon receive an email with a link to access and update your preferences.