- Investment Strategy Analyst

Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

United States, Institutional

Changechevron_rightThank you for your registration

You will shortly receive an email with your unique link to our preference center.

The views expressed are those of the authors at the time of writing. Other teams may hold different views and make different investment decisions. The value of your investment may become worth more or less than at the time of original investment. While any third-party data used is considered reliable, its accuracy is not guaranteed. For professional, institutional or accredited investors only.

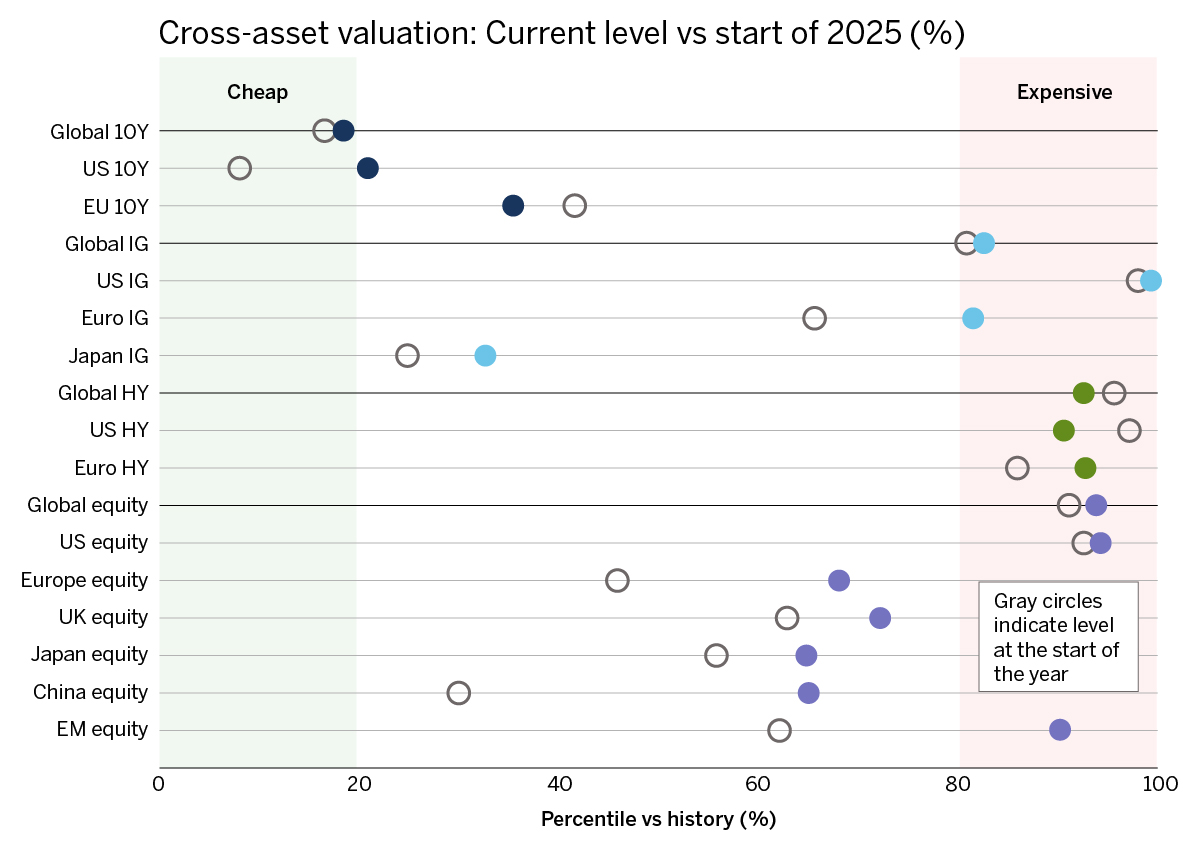

Valuations took a hit following Trump’s Liberation Day announcement in April, rattling risk assets amid trade uncertainty. However, markets have since rebounded, rallying on finalized tariff agreements and a lower headline risk outlook. Though global growth and inflation have generally remained resilient despite the volatility, there are cracks starting to appear, most notably in recent US employment data.

Amid all these developments, equity valuations are generally more expensive now than at the start of the year. Are higher equity and credit valuations rational in today’s environment? Valuation changes impact returns in the short term, but over a longer horizon, structural factors like dividends and earnings growth tend to be more meaningful return drivers.

In terms of the new tariff-induced macro backdrop, redefining a trade “win” as merely avoiding a worst-case outcome may not fully justify optimism, but there are other macro developments to be constructive about globally. Although valuations are more expensive, they are only one lens through which to analyze markets, and we believe opportunities remain for long-term multi-asset investors.

Figure 1

Sources: Wellington Management, Refinitiv | Equity valuation measured as percentile of forward 12-month price/earnings. Government bond valuation measured as percentile of 10-year yield. Credit valuations measured using percentile of credit spread. | Percentiles measured using weekly data from 7 September 2003 to 3 August 2025. | Information presented contains forward-looking statements. Actual results and occurrences may vary, perhaps significantly, from any forward-looking statements made.

Experts

Related insights

Chart in focus: The long-term case for quality equity

Continue readingChart in Focus: Is AI a bubble, or is it driving real market value?

Continue readingChart in Focus: Is the Fed rate cut positive for risk?

Continue readingChart in Focus: Three reasons to keep the faith in US credit quality

Continue readingChart in focus: What tech in 2000 teaches us about tomorrow

Continue readingChart in focus: Three reasons to revisit emerging markets

Continue readingChart in Focus: What do higher long-end yields mean?

Continue readingURL References

Related Insights

Get our latest market insights straight to your inbox.

Thank you for your registration

You will shortly receive an email with your unique link to our preference center

Chart in focus: The long-term case for quality equity

Our equity experts highlight the resilience of quality equities despite recent setbacks, emphasizing their historical outperformance.

Chart in Focus: Is AI a bubble, or is it driving real market value?

AI isn't just about the hype. Our experts explain why this innovation is driving real market value and lay out the investment implications.

Chart in Focus: Is the Fed rate cut positive for risk?

In this edition of Chart in Focus, we examine how the Fed’s long-awaited interest rate cut may influence risk assets.

Chart in Focus: Three reasons to keep the faith in US credit quality

Our fixed income experts highlight the resilience of US institutional credibility.

Chart in focus: What tech in 2000 teaches us about tomorrow

In this Chart in Focus, Equity Strategist Andrew Heiskell illustrates what 2000s tech can teach us about AI and innovation today and tomorrow.

Chart in focus: Three reasons to revisit emerging markets

Multi-Asset Strategist Nanette Abuhoff-Jacobson illustrates the case for emerging markets in three charts.

Chart in Focus: What do higher long-end yields mean?

Long-end yields have climbed on concerns over structural growth and fiscal expansion. In this edition of Chart in Focus, we explore how shifting yield curves are reshaping opportunities across asset classes.

Chart in Focus: Fed rate cuts resume — What’s next for investors?

In this edition of Chart in Focus, we explore the Fed’s return to rate cuts after a strategic pause. We examine how this move, alongside diverging central banks paths, could shape the outlook for risk assets.

Chart in Focus: Are today’s equity returns too high?

In this edition of Chart in Focus, we examine the strength of markets so far this year, placing it in historical context.

Chart in Focus: Where are rates headed?

In this edition of Chart in Focus, we take a look at where rates have been headed and potential implications moving forward.

Chart in Focus: Earnings upgrades fueled the recent US equity market rally

Where are earnings heading? In this edition of Chart in Focus, we address the recent uptick in earnings expectations and its potential impact on equity returns.

URL References

Related Insights

© Copyright 2026 Wellington Management Company LLP. All rights reserved. WELLINGTON MANAGEMENT ® is a registered service mark of Wellington Group Holdings LLP. For institutional or professional investors only.

Enjoying this content?

Get similar insights delivered straight to your inbox. Simply choose what you’re interested in and we’ll bring you our best research and market perspectives.

Thank you for joining our email preference center.

You’ll soon receive an email with a link to access and update your preferences.