Important considerations and a potential framework

With these difficulties in mind, what are the main points that investors need to consider when measuring the impact of climate resilience solutions?

Understand the context

Investors need to create a detailed picture of the anticipated impact of climate change and the local vulnerabilities. Guiding questions that can help achieve those goals include:

- Can we obtain the relevant data and qualitative information for the associated climate risks and vulnerabilities?

- What are the major drivers of climate and non-climate-related changes? Do we understand how they interrelate and how they feed into our assessment?

- Is the proposed solution appropriate for the context? Can we identify sections of the population, regions or sectors as being at particular risk?

Clearly define how the solution will lead to increased resilience to climate change

Investors need to clearly explain how the product or service offered by the company will contribute to reducing vulnerability/strengthening resilience and articulate the underlying assumptions on how change might happen. Examples include assessing:

- the affordability of a proposed product or service, especially given that the effects of climate change disproportionately affect poorer communities

- potential technological barriers to adoption (such as legacy processes or infrastructure)

- reluctance to changing the status quo if the solution requires behavioural change on the part of the end consumer

It is also imperative to revisit these hypotheses and assumptions regularly to account for uncertain climate projections and socioeconomic changes.

Use output-related indicators as proxies

The indicators chosen to measure impact should plausibly demonstrate the contribution of the solution to climate resilience bearing in mind the relevant context. It is essential to make the most of the available data — even if it doesn’t capture the entire story.

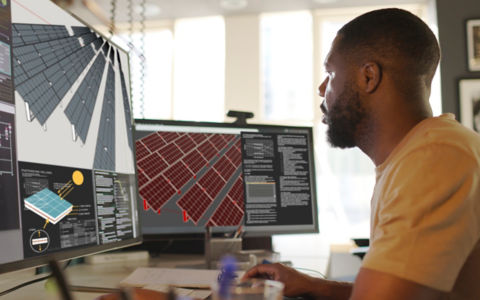

Context: Increased frequency of extreme weather is leading to a higher risk of power outages and an increased need for backup power supply in the home. For example, around 83% of reported major power outages in the US have been linked to weather-related events.1 When looking at solutions that increase household resilience to power outages such as backup, flexible or renewable power, the ultimate climate resilience benefit relates to a decrease in vulnerability to power outages. This is a narrow measure that is difficult to capture in one number, as it is dependent on hard-to-predict factors such as the likely number of weather-related events or people’s future behaviour. Using a simple output-related metric such as the number of units sold, or number of households served, supported by detailed research linking these metrics to better climate resilience is an imperfect, yet practical solution.

Engage with companies to enhance disclosure

Not all companies publish the necessary data to demonstrate the impact that their products or services have on climate resilience. Speaking directly to company management, sustainability, or investor relations teams to highlight the importance of this disclosure is crucial.

Context: Many companies are already used to disclosing environmental data on their own operations products and services. Actively engaging with companies to highlight how climate resilience metrics (or the necessary proxies to calculate them) are a natural but crucial extension of that process may help to encourage more detailed disclosure in the future.

Look at a wide range of data:

Solutions that increase climate resilience are interdependent on various environmental and socioeconomic factors, which are difficult to control. Success is not guaranteed if implemented in isolation. Hence the importance of also looking at a wide range of data, which, while not attributable to the project in isolation, can still have a bearing on its success.

Context: When looking at a solution that aims to help increase the yield of a certain crop by making the growing process more resistant to extreme weather, we would also consider factors affecting the overall food supply chain in the relevant region as an additional lens. We can use this data to assess the significance of a solution in a wider, regional context.

Conclusions

In combination, we think these guidelines can serve as a useful framework for investors looking to measure the impact of investments in climate resilience. In our view, it offers the necessary flexibility to deal with the inherent methodological challenges, imperfect and limited data sets and complex objectives.

The challenge of measuring the impact of climate resilience should, in our view, not limit much needed investment in this area. The latest UN estimates that the so-called adaptation finance gap has now reached US$194–366 billion per year2. As part of a global ecosystem that includes policymakers, companies and individuals, impact investors can generate attractive returns while playing an important role in reducing this climate resilience funding gap.