How durable are today’s AI infrastructure investments?

Over half of AI-related investment targets chips and hardware, but rapid advances mean these assets may have shorter lifespans than before. Data centres built for training large models could see their value shift as AI workloads evolve and supply catches up with demand. Issuers able to adapt infrastructure and balance sheets to changing technology will be better positioned to maintain credit quality and avoid stranded assets.

Will AI investments deliver the anticipated returns?

AI’s commercial potential is significant, but the timeline for adoption, productivity gains and profitability remains uncertain. Many businesses are still determining how to integrate AI, and revenue from new AI infrastructure may take time to materialise or face temporary setbacks. If the expected boost is delayed, some projects could struggle to meet return targets, increasing the risk of funding pullbacks or repricing in credit and equity markets.

Could looser lending standards make the market more vulnerable?

The surge in AI-related financing has led to more complex and less transparent structures, with some deals relying on looser underwriting standards. Recent US defaults — though not directly tied to AI — have revealed challenges and irregularities, reminding investors that excess and opacity can quickly translate into broader stress. As more risk is warehoused outside traditional banking channels, investors should remain alert to potential ripple effects across the capital structure.

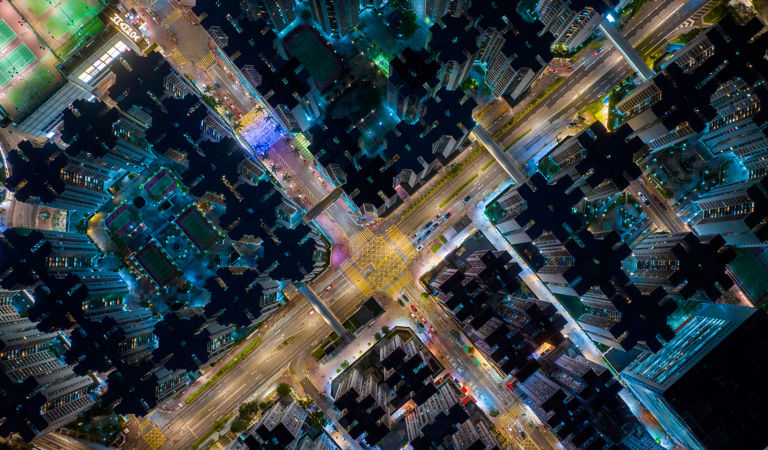

The scale of AI-related investment has made the sector a significant driver of US economic activity, but this reliance introduces vulnerability. Within credit markets, this risk is illustrated by the growing proportion of AI-linked issuers in the liquid USD investment-grade universe. They now represent approximately US$1.2 trillion in debt, or 14% of the universe, surpassing even US banks. If treated as a standalone sector, this cohort would be the largest in the universe, underscoring how closely the credit cycle is now tied to the trajectory of AI.

Should confidence in the viability or sustainability of AI investments weaken, the impact could be swift and far-reaching, potentially triggering repricing and increased volatility across risk assets. A better understanding of AI’s trajectory is fast becoming a key input when seeking to establish the likely direction of the economic and credit cycle. It will also increasingly affect the fortunes of virtually all issuers, meaning careful analysis and ongoing vigilance by credit investors is imperative.