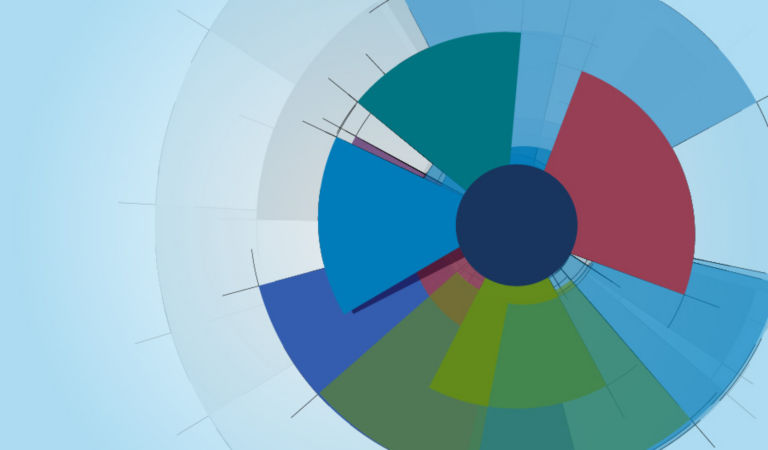

Equities

Global equities (-2.2%) fell in October. Equities remained steady for most of the month but sold off in the final days, as investors awaited key US elections, navigated heightened geopolitical tensions in the Middle East, and assessed ongoing policy easing measures. Favorable US economic data drove expectations that the US Federal Reserve (Fed) may slow its pace of rate cuts. This sentiment was further emphasized by the notable rise in 10-year Treasury yields, which reached 4.28% in October, up from a 15-month low of 3.62% in late September, underscoring the market’s expectations for the pace of Fed rate cuts, positive economic indicators, and improved prospects for a soft landing. In Europe, third-quarter GDP exceeded expectations, and the European Central Bank (ECB) lowered interest rates by 25 basis points (bps), to 3.25%, amid waning inflation and a weak economic outlook. Japan’s Liberal Democratic Party-led coalition lost its parliamentary majority in national elections, generating political and monetary policy uncertainty. Emerging markets faced pressure from a stronger US dollar, while the conflict in the Middle East reached its one-year mark, with military strikes escalating between Israel and Iran.

US

US equities (-0.9%) snapped a streak of five consecutive monthly gains amid heightened volatility and presidential-election uncertainty. A selloff in some mega-cap technology companies at the end of October drove the major indices sharply lower, and a batch of strong economic data (job growth, consumer spending, consumer confidence) prompted financial markets to recalibrate for a potentially slower pace of interest-rate cuts by the Fed. US GDP expanded at a brisk 2.8% annualized pace in the third quarter, modestly below expectations of 3.1%. Growth was driven primarily by robust consumer spending, as well as government outlays that pushed the budget deficit up to US$1.8 trillion in 2024, the highest-ever level outside of the pandemic relief periods of 2021 and 2022. The core Personal Consumption Price Index accelerated 0.3% in September (2.7% annually), following a 0.2% increase in August, causing concern that inflation would continue to rise. According to FactSet, of the 70% of companies in the S&P 500 Index that had reported third-quarter earnings, the blended year-over-year earnings growth for the index was 5.1%, better than the 4.3% estimate on September 30. The forward 12-month price-to-earnings ratio for the index was 21.3, above the 10-year average of 18.1.

Economic data released during the month signaled the economy’s ongoing resilience. In September, surprisingly robust job growth eased fears about the recent deterioration in the labor market. Nonfarm payroll growth of 254,000 significantly exceeded expectations, the unemployment rate dipped to 4.1%, and initial jobless claims fell to a five-month low at the end of October. The number of job openings fell sharply amid hurricane disruptions, but layoffs remained relatively low. Stronger-than-expected consumer spending in September continued to propel the economy, with headline retail sales accelerating at a brisk monthly pace of 0.4% and personal spending advancing 0.5%. After a steep decline in September, the Conference Board’s Consumer Confidence Index rebounded to its highest level (108.7) since January, driven by sharp improvements in views of present conditions and future expectations. Notably, the proportion of consumers expecting a recession waned. Housing market data was mixed amid a surge in mortgage rates in October that posed greater headwinds for the demand for houses.

In October, the manufacturing sector contracted for the seventh straight month, with the Institute of Supply Management (ISM) Manufacturing Index receding to its lowest level since July 2023. Activity was dragged down by a marked decline in production and shrinking inventories, as companies awaited more clarity about future economic policies in the aftermath of the presidential election. In sharp contrast, the services sector expanded at the fastest pace since February 2023; solid consumer spending lifted the ISM Services Index to 54.9 in September, well above the August reading of 51.5 and consensus expectations of 51.7. Small business sentiment remained stable at a historically low level.

Within the S&P 500 Index (-0.9%), eight of the 11 sectors posted negative results for the month. Health care (-4.6%) was the worst-performing sector, led lower by health care providers & services (-7.2%) and pharmaceuticals (-4.6%). Materials (-3.5%) and real estate (-3.3%) also underperformed. Financials (+2.7%) was the best-performing sector. Communication services (+1.9%) and energy (+0.8%) also outperformed.

Europe

European equities (-2.8%) slid in October. The eurozone economy expanded by 0.4% in the third quarter, beating expectations of 0.2%, but escalating trade tensions with China and muted consumer confidence contributed to a weak economic outlook. The region’s business activity contracted for the second straight month as the HCOB Flash Eurozone Composite Purchasing Managers’ Index (PMI) stabilized at 49.7. Activity in the region was weighed down by Germany’s faltering industrial sector, which struggled against costlier energy and weak Chinese demand. Eurozone employment decreased for the third straight month and at the fastest pace since the end of 2020, although the labor market remained healthy amid record-low unemployment of 6.3% in September. Against a backdrop of lackluster economic growth, the ECB lowered interest rates for the third time this year, by 25 bps, to 3.25%. Annual eurozone headline inflation rose to 2.0% in October, up from 1.7% in September, but still meeting the ECB’s target and bolstering the prospect of another rate cut in December. Core inflation remained steady at 2.7%. The European Union increased tariffs on Chinese electric vehicles to as much as 45.3%, risking retaliation from China. Third-quarter earnings for companies in the STOXX 600 Index are forecast to increase 6.2% from a year earlier, according to LSEG.

Europe’s manufacturing downturn slowed slightly in October; the HCOB Eurozone Manufacturing PMI increased to 46.0 as contractions in production, sales, and employment eased, but business confidence slipped to a one-year low. Input costs decreased for the second straight month, and output prices continued to fall. The HCOB Flash Eurozone Composite PMI revealed that services sector activity continued to expand, but at the slowest pace in eight months amid softening new orders. The European Commission’s Economic Sentiment Indicator dipped to 95.6 in October; industry confidence worsened, while consumer confidence improved.

Germany’s (-1.8%) economy unexpectedly grew by 0.2% in the third quarter and avoided a technical recession, driven by government and household spending. The ZEW Indicator of Economic Sentiment improved drastically and beat forecasts, but the assessment of the current economic situation continued to worsen. In the UK (-1.4%), Chancellor Rachel Reeves unveiled an expansionary budget that markets judged to be inflationary, while the Office for Budget Responsibility upgraded the UK’s 2024 economic growth forecast to 1.1%, thanks to falling inflation and lower interest rates. The S&P Global Flash UK PMI Composite Output Index showed that business activity in manufacturing and services continued to expand in October, but at a slower pace. In the third quarter, France’s (-3.8%) economic growth accelerated at a 0.4% quarterly pace, above forecast, due to the impact of the Paris Olympic Games; Spain’s (-1.1%) GDP grew faster than expected, at 0.8%, thanks to a strong tourism season and exports; Italy’s (+0.6%) economy flatlined, as an increase in domestic demand was offset by negative trade flows.

Pacific Basin

Pacific Basin equities (+0.8%) ended the month higher. In Australia (-1.5%), the Reserve Bank of Australia (RBA) left interest rates unchanged at 4.35%, remaining wary of the upside risks to inflation. RBA Governor Michele Bullock signaled that policy is likely to remain restrictive for some time amid concerns about the degree of excess demand in the economy. Core inflation remained elevated, with prices rising 0.8% in the third quarter and 3.5% for the year, in line with expectations. Despite his cautious rhetoric, Treasurer Jim Chalmers indicated that Australia is on track for a soft landing as policymakers have managed to contain inflation without a significant reduction in domestic growth. Lackluster spending data suggested that consumers were feeling the strains of stubborn inflation and high interest rates; retail sales rose only 0.1% in September, a significant decrease from 0.7% in August, while total household spending dipped 0.1% after a 0.2% gain a month earlier.

Japan (+2.3%) faces an uncertain political future after the Liberal Democratic Party’s ruling coalition lost its parliamentary majority in a snap election. The Bank of Japan (BOJ) kept its benchmark interest rate unchanged at 0.25% and indicated that inflation is on track to meet its 2% target. BOJ Governor Kazuo Ueda stated that interest rates will increase if prices and the economy stay in line with the central bank’s forecasts, strengthening the market’s view that the BOJ will raise rates in the coming months. This belief prompted the yen to appreciate versus the US dollar, but not enough to erase the losses triggered earlier in October after new Japanese Prime Minister Shigeru Ishiba surprisingly stated that Japan wasn’t currently ready for higher borrowing costs. For the first time in several months, inflation slowed in both Tokyo and Japan in October but was still stronger than anticipated. Economists noted the slowdown was largely driven by government subsidies and is not likely to have a significant impact on overall price trends or the BOJ’s policy path. Despite the biggest increase in base salaries in nearly 32 years, declines in inflation-adjusted wages and household spending in August reflected the impact of accelerated price increases, strengthening the case for higher interest rates.

In Singapore (-0.8%), the Monetary Authority of Singapore left interest rates unchanged, defying a global wave of policy easing as the city-state’s economy accelerated faster than expected in the third quarter amid a robust rebound in the manufacturing sector. In September, headline inflation was the lowest in over three years; however, elevated year-over-year core inflation of 2.8% supported the central bank’s decision to keep monetary policy settings tight. Hong Kong’s (-5.9%) GDP slowed to 1.8% year over year in the third quarter, the weakest pace in five quarters. Declining exports and lower private consumption highlighted the challenging external and domestic demand environment facing the city.

Emerging Markets

Emerging markets (EM) equities (-2.7%) fell in October. Asia led the decline, followed by Europe, the Middle East, and Africa (EMEA), and Latin America.

In Asia (-3.1%), China’s (-5.6%) economy continued to slow as third-quarter GDP grew at an annual rate of 4.6%, its slowest pace since early 2023 and down from 4.7% in the second quarter. The sharp property sector downturn, alongside weakening export growth and deflationary pressures, continued to weigh on the economy. The government announced additional support for the struggling economy that focused on technical issues such as payment regulations, management of projects, and the deployment of bonds for financing in an attempt to boost investment and spending and support small- and medium-sized businesses. Additionally, the People’s Bank of China cut key lending rates by 25 bps and signaled that it could lower the reserve requirement ratio further. In India (-7.3%), the Reserve Bank of India kept its key interest rate at 6.5% but tweaked its policy stance to “neutral”, opening the door for potential rate cuts amid early signs of slowing economic growth. Annual retail inflation rose to a nine-month high of 5.5% in September due to rising food prices. Taiwan’s (+5.0%) GDP expanded at a higher-than-expected annual pace of 4.0% in the third quarter due to solid export growth, aided by stronger demand for new applications such as AI-related products.

In EMEA (-1.9%), Saudi Arabia (-1.5%) fell as the Ministry of Finance slashed its 2024 GDP forecast to 0.8%, from a previous estimate of 4.4%, and lowered its projections for GDP growth in 2025 and 2026 to 4.6% and 3.5%, respectively. It also raised budget deficit estimates for fiscal years 2024 – 2026. Low oil prices continued to hamper the kingdom’s ability to invest in projects as the breakeven oil price needed to balance the government’s budget continues to rise. The United Arab Emirates (-1.9%) fell despite second-quarter economic growth of 4.1% in the capital, driven by 6.6% growth in the non-oil sector, which accounts for about 55% of the economy. South Africa’s (+0.1%) inflation dropped sharply to 3.8% in September, from 4.4% in August, increasing the likelihood of another rate cut.

In Latin America (-0.9%), Brazil’s (-0.4%) inflation accelerated to 4.5% in the 12 months to mid-October, up from 4.1% the month before, driven by higher residential electricity costs due in part to a major drought. In Mexico (-2.9%) third-quarter GDP surprisingly rebounded at the fastest quarterly pace in more than a year, although economic growth this year has been disappointing. Annual inflation slowed to a six-month low of 4.58% in September. Chile’s (+1.4%) central bank cut interest rates by 25 bps, to 5.25%, predicting that rates will fall to 4.75% within five months and that it will reach its 3% inflation target within two years.

Fixed Income

Generally encouraging economic releases contributed to rising sovereign yields, against a backdrop of political uncertainty stemming from the US elections and intensifying tensions in the Middle East. Most fixed income sectors outperformed duration-equivalent government bonds.

US economic data releases were mixed, strained in part by the impact of two major hurricanes. Retail sales broadly gained across most categories; however, consumers remained frustrated by persistently high prices. The NFIB Small Business Optimism Index missed expectations, while consumer confidence improved according to the Conference Board on a positive assessment of the labor market. Industrial production stalled amid hurricane impacts and a strike at Boeing. The ISM Manufacturing Index remained in contractionary territory as production and demand cooled. In housing data, increased borrowing costs and higher sales prices negatively impacted existing-home sales, while new-home sales gained. Eurozone annual inflation edged higher. Constrained new orders and backlogs weighed on the manufacturing PMI. Germany’s ifo Business Climate Index rose, with improvements in current conditions and future expectations. The UK’s S&P Global Manufacturing PMI edged lower but stayed in expansionary territory as an improvement in new orders was offset by the higher cost of raw materials. China’s Caixin Manufacturing PMI beat expectations as new orders grew at the fastest rate in four months. Industrial production advanced, owing to the equipment sector and high-tech manufacturing. Japan’s machine tool orders, a leading indicator of future capital spending, declined on the year. In Canada, auto purchases lifted retail sales, the unemployment rate ticked down, and urban housing starts advanced.

Global economic developments pointed to a potential reduction in rate cuts. The ECB cut rates for a third time, as anticipated. Most other major central banks left policy rates unchanged. In the UK, Chancellor Rachel Reeves’ budget announcement signaled up to £141 billion net borrowing over the next five years, significantly higher than the levels expected in the March budget and the £85 billion consensus.

Global sovereign bond yields moved higher across major developed economies, reversing the downward trajectory from August and September. Signs of a strikingly resilient US labor market, and resurgent oil prices due to fears about an escalating Middle East conflict raised concerns about revived inflationary pressures, leading markets to anticipate fewer rate cuts by the Fed. German bund yields climbed, while eurozone GDP surprised to the upside in the third quarter. However, inflation in October rose more than expected, weakening the case for jumbo rate cuts by the ECB. In the UK, Chancellor Rachel Reeves’ budget announcement sent gilt yields close to their highest level since the 2008 global financial crisis. In EM, divergence in central banks’ easing cycles continued. In Mexico, Banxico signaled bigger rate cuts as inflation continued to moderate, while Brazil’s robust labor market contributed to inflation concerns. The Bloomberg TIPS index delivered a total return of -1.79%, and the 10-year breakeven inflation rate increased by 14 bps to 2.33% during the month.

Global credit outperformed duration-equivalent government bonds as spreads tightened. Within the securitized sectors, commercial mortgage-backed and asset-backed securities outperformed, while agency mortgage-backed securities underperformed duration-equivalent government bonds. In EM, local markets debt (-4.61%) underperformed external debt (-1.72%) in US-dollar terms. Spread narrowing contributed favorably to external debt performance, while an increase in US Treasury yields had a negative impact. Depreciation in EM currencies and higher rates drove the negative performance within local markets.

Currencies

The US dollar appreciated against major developed market and EM currencies, helped by tempered expectations for Fed rate cuts and a higher probability that Donald Trump would be elected president. Among the G10, the New Zealand dollar was weighed down by a strong US dollar, disappointing domestic economic data, potentially bigger rate cuts by the Reserve Bank of New Zealand, and lingering concerns around China. The Japanese yen hit a three-month low against the US dollar, as an election loss by Japan’s ruling coalition caused political and monetary policy uncertainty. Within EM, performance was broadly negative. Latin American currencies led the decline. The Brazilian real plunged to a near three-month low as the country’s current account deficit widened in September. The Mexican peso hit a two-year low against the US dollar, with investors focused on developments around judicial reforms.

Commodities

Commodities (+0.5%) ended higher in October. Precious metals and energy contributed during the period, while industrial metals and agriculture & livestock detracted.

Energy (+1.5%) increased during the period. Gasoline (+3.7%), heating oil (+3.6%), crude oil (+2.7%), and gas oil (+1.9%) rose amid fears that escalating conflict in the Middle East could result in additional supply disruptions. A potential delay of a planned increase in oil output by OPEC+ and strong demand in the US also supported oil prices. In contrast, natural gas (-20.3%) slid on light demand due to a moderate weather forecast in the near term, while production remained high. In addition, anxiety about supply disruptions eased after Israeli missile strikes did not target major energy infrastructure in Iran.

Industrial metals (-2.6%) pulled back as the Chinese government did not provide additional measures to boost government spending, and previous stimulus measures failed to show any significant improvement in metals demand. Nickel (-10.5%), lead (-4.0%), copper (-3.4%), zinc (-1.5%), and aluminum (-0.1%) fell during the period.

Precious metals (+3.9%) rose for the fourth consecutive month. Silver (+4.7%) and gold (+3.8%) prices remained strong as global economic uncertainty, interest-rate cuts, geopolitical tensions in the Middle East, and uncertainty ahead of the US presidential election continued to support demand for the safe-haven assets.

Agriculture & livestock (-1.1%) ended the period lower. Lean hogs (+14.8%) rallied on strong US demand for pork bellies and ham ahead of the Thanksgiving and Christmas holidays. Sugar (+1.6%) ended higher due to lower rain forecast in the near term in Brazil’s main sugar production region in São Paulo. Live cattle (+1.2%) prices were up due to lower inventory, while demand remained strong. Feeding costs also rose as recent droughts pushed some producers to feed cattle with hay. Coffee (-8.7%) fell as recent rainfall in the Minas Gerais state of Brazil helped ease drought concerns, while the harvest in Vietnam was expected to accelerate in November. Soybeans (-7.1%) slid as higher rainfall improved planting conditions in Mato Grosso, Brazil’s largest production state for soybeans. Cotton (-5.1%) prices fell as a stronger dollar and weaker prices for crude oil prompted international buyers to favor cheaper alternatives such as polyester fiber.

Quarterly Market Review — 4Q2025

A monthly update on equity, fixed income, currency, and commodity markets.

By