Equities

Global equities (+2.5%) rose in January despite elevated geopolitical risks. International stocks outperformed US stocks, and value led growth, as equities advanced for the ninth consecutive month following the US “Liberation Day” tax and trade reset. Markets absorbed renewed trade tensions and more assertive foreign‑policy signals from the US government, notably involving Greenland, Venezuela, Iran, and the Russia-Ukraine conflict. These developments lifted volatility across commodities and perceived safe‑haven assets, yet equity markets were largely unimpacted by the headlines. Major central banks held interest rates steady, while the nomination of former US Federal Reserve (Fed) Governor Kevin Warsh as the next chair of the Fed sharpened the market’s focus on policy continuity and the Fed’s independence.

At Davos, Canadian Prime Minister Mark Carney warned that the rules‑based global order is breaking down, arguing that heightened great‑power rivalry will reshape trade, geopolitics, and investment risk for years to come. In France, passage of the 2026 budget via Article 49.3 — which allows the government to pass a bill without a parliamentary vote — stabilized near‑term governance; however, a deficit near 5% of GDP continued to weigh on sovereign spreads, particularly against Germany. Japanese equities proved relatively resilient during a bout of heightened cross‑asset volatility triggered by Prime Minister Sanae Takaichi’s decision to call a February snap election and propose a temporary suspension of the food component of the consumption tax. While long‑dated Japanese government bonds sold off sharply, yen weakness supported exporters and improved earnings translation for Japanese companies. China’s 4.5% full‑year 2025 GDP growth masked a fourth‑quarter slowdown, reflecting weak consumption and falling fixed‑asset investment. Still, resilient exports, firm commodity prices, anticipated policy support, and sustained AI‑related demand supported Chinese equities and broader emerging markets performance.

US

US equities (+1.5%) advanced for the ninth consecutive month. Value stocks significantly outpaced their growth peers, while the Russell 2000 Index of small-cap equities registered its highest monthly gain since August 2025. In January, high-frequency data across the labor market, consumer spending, industrial production, travel demand, and credit availability suggested that the economy is growing at an above-trend pace. In December, headline and core Consumer Price Index inflation rose at a slower-than-expected annual rate of 2.7% and 2.6%, respectively, providing a clearer sign of cooling price pressures after data disruptions from the government shutdown cast some doubt on the soft inflation readings in November. Against a backdrop of solid economic growth, dissipating inflation, and reduced labor market risks, the Fed left interest rates unchanged, as widely expected. President Donald Trump nominated former Fed Governor Kevin Warsh to succeed Fed Chair Jerome Powell in May, with Warsh recently signaling a preference for interest-rate cuts in the near term and favoring a significantly smaller Fed balance sheet. If confirmed by the Senate, he would likely boost the Fed’s efforts to ease banking rules and allow the government more authority on regulation and supervision.

Economic data released during the month was mixed. In December, lower-than-expected job growth underscored a soft, albeit resilient, labor market; nonfarm payrolls increased by a modest 50,000, while the unemployment rate dropped to 4.4%, from 4.6%. Jobless claims remained relatively low in January, while the Bureau of Labor Statistics reported that job openings in November were the lowest in more than a year. Government consumer spending data for December was delayed due to the backlog caused by the government shutdown. However, headline retail sales in November rose at a solid 0.6% monthly pace, while private reports showed that spending in November and December rose approximately 4% from the previous year, driven by higher-income households. Healthy consumer spending contrasted with weak consumer sentiment, as the Conference Board’s Consumer Confidence Index unexpectedly plunged 9.7 points to 84.5 in January, on dimmer views of present conditions and future expectations. Housing market data was mixed in December. Existing-home sales climbed at the fastest pace since 2023, but pending sales of existing homes fell by the most since April 2020.

The manufacturing sector expanded in January for the first time in a year; the Institute of Supply Management (ISM) Manufacturing Index increased to 52.6, thanks to a significant rebound in new orders and higher production. In December, solid demand growth and greater hiring boosted the ISM Services Index more than anticipated, to 54.4, the highest level since October 2024. The NFIB Small Business Optimism Index rose for the second straight month, as improved expectations for business conditions, receding inflation, and less uncertainty outweighed softer sentiment about sales growth and hiring.

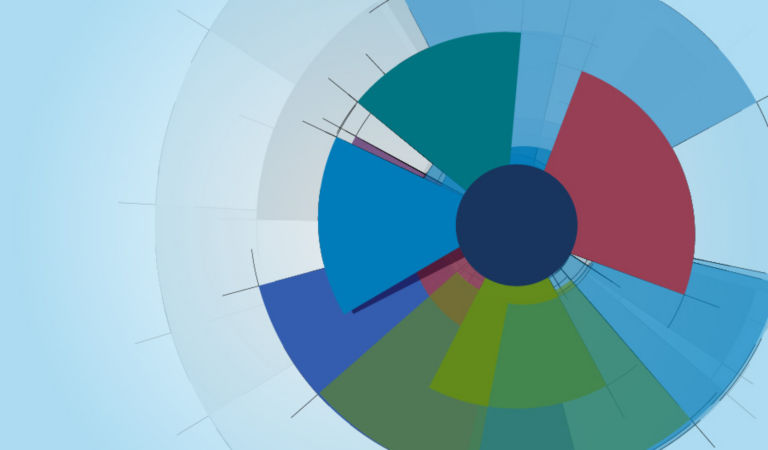

Within the S&P 500 Index (+1.5%), 8 of the 11 sectors posted positive results for the month. Energy (+14.4%) was the best-performing sector. Materials (+8.7%), consumer staples (+7.7%), and industrials (+6.7%) also outperformed. Financials (-2.4%) was the worst performing sector, while information technology (-1.7%) and health care (-0.0%) also lagged the index.

Europe

European equities (+2.6%) ended higher. Despite higher US tariffs, surging export competition from China, and sustained geopolitical tensions, the eurozone economy was resilient. Fourth-quarter GDP grew at a faster-than-expected 0.3% quarterly pace, driven by higher household consumption and government spending. Eurozone business activity continued to expand in January, as the HCOB Flash Eurozone Composite Purchasing Managers’ Index (PMI) was unchanged at 51.5. Notably, German output remained on an upward trend, but French business activity fell back into contraction as political turmoil over the budget weighed on demand. Against a relatively positive economic backdrop, the central banks of Norway and Sweden kept interest rates unchanged. The European Central Bank (ECB) signaled that policy rates will likely remain unchanged in the near term, but it may consider a rate cut if further appreciation in the euro begins to weigh on the bank’s inflation outlook. Annual eurozone headline inflation fell to 1.7% in January, while core inflation dipped to 2.2%, the lowest level since October 2021. President Trump threatened to pose new tariffs on many European nations unless he reached a deal to purchase Greenland. However, his stance softened after a framework for a future agreement on Greenland was reached during a meeting with NATO chief Mark Rutte. According to LSEG, fourth-quarter earnings for companies in the STOXX 600 Index are forecast to decrease 3.9% from a year earlier.

In January, Europe’s manufacturing sector contracted modestly for the third straight month. Despite persistent weakness in new orders, the HCOB Eurozone Manufacturing PMI increased to 49.5, as output continued to expand marginally. Notably, input prices accelerated to a three-year high, while output prices continued to fall slightly. The HCOB Flash Eurozone Composite PMI revealed that services sector activity expanded in January for the eighth consecutive month, helping to offset a decline in manufacturing. Both input costs and output price inflation increased at a faster pace. The European Commission’s Economic Sentiment Indicator increased markedly to 99.4 in January, with consumer and industry confidence improving.

Germany’s (+0.4%) economy grew by 0.2% in 2025 — the first expansion since 2022 — thanks to higher consumer and government spending. Private-sector investments and exports continued to decline. Encouragingly, the ZEW Indicator of Economic Sentiment rose sharply to 59.6 in January, well above expectations of 50 and the highest since July 2021. The UK’s (+3.1%) economy beat expectations with 0.3% growth in November, boosted by a manufacturing recovery. The S&P Global Flash UK PMI Composite Output Index indicated that business activity grew significantly in January, supported by a robust and accelerated upturn in the services sector. Annual headline inflation rose more than expected to 3.4% in December. France (-0.1%) finally adopted a 2026 budget after Prime Minister Sébastien Lecornu survived a series of no-confidence votes after invoking Article 49.3 of the Constitution to push through a budget without a vote in the National Assembly. Spain’s (+3.9%) economy grew at a robust 0.8% pace in the fourth quarter and by 2.8% in 2025, supported by a booming tourism sector and solid household spending.

Pacific Basin

Pacific Basin equities (+4.5%) rose over the month. In Japan (+4.9%), Prime Minister Sanae Takaichi dissolved parliament and called for a snap election on February 8 in hopes of securing a larger majority to advance major policy changes. She also announced a two-year suspension of sales tax on food, igniting a rout in Japan’s long‑term bonds that sent 40‑year yields to their highest levels since their debut in 2007 and stoked concerns over how the government will fund the measure. Against this backdrop, the Bank of Japan (BOJ) left its policy rate unchanged at 0.75% after last month’s hike and nudged its fiscal 2026 inflation forecast up to 1.9% from 1.8%. A dissenting vote lifted market expectations for an April rate hike; however, Governor Kazuo Ueda avoided signaling an imminent hike, noting that the economy remains “some distance” from the 2% inflation target. Japan’s core inflation slowed sharply to 2.4% in December from 3.0% in November due to newly introduced fuel subsidies. Headline inflation fell to 2.1%, its lowest level since March 2022. Despite the policy-driven pullback, core inflation averaged 3.1% in 2025, the fourth consecutive year above the BOJ’s 2% target. This suggested that price pressures remain firm amid solid wage growth and a weak yen, keeping the door open for further hikes.

In Australia (+1.5%), softer-than-expected CPI inflation in November briefly eased pressure on the Reserve Bank of Australia (RBA); however, persistent housing-driven inflation and sticky core components led markets to predict a February interest-rate hike. This sentiment was reinforced by December’s unemployment rate, which fell to 4.1%, underscoring the RBA’s view of a still tight labor market. Additionally, a larger-than-expected surge in job growth strengthened the case for near-term tightening, pushing three-year yields to a two-year high and sending the Australian dollar to a three year high, even though underlying trends remain softer as annual job growth continues to lag the expanding labor force. Fourth-quarter CPI inflation rose 0.6% to 3.6%, with core inflation climbing to a five-quarter high of 3.4%. December inflation also exceeded expectations at 3.8% year over year, driven by a sharp 5.5% rise in housing costs.

Singapore’s (+2.8%), economy ended 2025 on a strong footing, with robust pharma and AI chip manufacturing driving a 5.7% fourth-quarter expansion and lifting full year growth to 4.8%, the highest since 2021. Headline and core inflation both increased to 1.2% in December, in line with estimates. As projected, the Monetary Authority of Singapore (MAS) held rates steady for a third straight meeting but flagged rising inflation risks amid resilient economic growth and solid demand. MAS also upgraded its fiscal-year 2026 inflation forecast and highlighted upside risks to its projections, leaving room for potential tightening later this year.

Hong Kong’s (+10.7%) full-year GDP grew 3.5% — its fastest pace since 2021 — underpinned by resilient trade, a rebound in investment, and strengthening domestic sentiment. The housing market notched its first annual price gain in four years as cheaper mortgages, mainland demand, and improving developer balance sheets reinforced optimism despite lingering geopolitical and policy risks.

Emerging Markets

Emerging markets (EM) equities (+8.8%) surged in January. Latin America led the gains, followed by Asia and then Europe, the Middle East, and Africa (EMEA).

In Latin America (+11.3%), Brazil’s (+12.4%) central bank signaled that it would begin cutting interest rates at its next meeting in March but stressed that monetary policy will remain restrictive to reduce inflation to target. Encouragingly, inflation eased to 4.3% year over year in December, the lowest level in more than a year. Despite months of punishing US tariffs, expanded shipments to China and other major trading partners boosted Brazil’s exports to record levels in 2025. Exports rose 3.5% in 2025, to US$348.7 billion, resulting in a US$68.3 billion trade surplus for the year. In Mexico (+5.8%), preliminary data from the national statistics agency INEGI showed that the economy expanded 2.3% in December compared with the same month a year earlier. Annual inflation accelerated to 3.77% during the first half of January, primarily driven by the scheduled adjustment to the Special Tax on Production and Services (IEPS) and new trade tariffs on goods from non-treaty countries.

In Asia (+8.8%), China’s (+4.9%) exports surged 6.6% in December from a year earlier, helping to push the country’s annual trade surplus to a record US$1.2 trillion, even as exports to the US fell 20%. GDP growth slowed to 4.5% in the fourth quarter — the weakest pace in nearly three years — due to lackluster consumer spending and a prolonged property market downturn. Manufacturing activity contracted mildly in January amid softening domestic demand. Consumer inflation rose 0.8% year over year in December, the fastest pace in nearly three years, as spending picked up ahead of the New Year holiday. However, factory-gate deflation remained entrenched, signaling that underlying demand remained weak. New-home prices continued to decline in December, falling 2.7% year over year and underscoring persistent strains in the property sector despite government pledges to stabilize it. Taiwan (+11.3%) reached a trade agreement with the US, in which Taiwanese chip and technology companies will invest at least US$250 billion in production capacity in the US in exchange for a 15% limit on “reciprocal” tariffs for most Taiwanese exports. Select exports will be subject to lower or no tariffs. South Korea (+28.0%) surged despite a hike in US tariffs from 15% to 25% due to accusations that South Korea’s legislature had not implemented the agreed-upon measures of the country’s trade deal with the US. Exports in January rose for the eighth consecutive month and at the fastest pace in four and a half years. Shipments increased 33.9% year over year, to US$65.85 billion, driven by robust semiconductor demand.

In EMEA (+7.4%), Saudi Arabia’s (+10.5%) economy grew 4.9% year over year in the fourth quarter, according to government estimates, helped by a 10.4% surge in oil-related growth as output ramped up in the latter half of 2025. Non-oil activities grew around 4%. South Africa’s (+4.8%) consumer price inflation ticked up to 3.6% in December. However, inflation appeared well contained, boosting expectations for multiple interest-rate cuts by the central bank in 2026.

Fixed Income

Global sovereign yields diverged during the month amid mixed economic data and heightened geopolitical uncertainty. Most fixed income sectors delivered positive excess returns, supported by tighter credit spreads, while major central banks held rates unchanged. According to Bloomberg, the US Aggregate Index returned 0.11%, outperforming duration-equivalent Treasuries by 0.22%, while the Global Aggregate Index returned 0.24% in US-dollar-hedged terms, outperforming duration-equivalent government bonds by 0.18%.

Global sovereign yields ended mixed. In the US, yields moved modestly higher amid stronger-than-expected economic data, the Fed’s decision to hold interest rates steady, the announcement of a new Fed Chair, and elevated geopolitical tensions involving Greenland. In Europe, yield curves steepened with front-end Bund yields declining on concerns over the euro’s strength and easing inflation. UK yields rose at the long end, reflecting persistent inflation pressures and firmer‑than‑expected economic data. Across Asia Pacific, Japanese yields increased amid speculation around a snap election and potential fiscal loosening. Australian yields also moved higher amid still elevated inflation and rising expectations for policy tightening by the RBA. EM yields ended broadly lower, led by South Africa, as optimism around the country’s economic and political outlook supported bonds. Mexican yields also fell as inflation eased to its lowest year‑end level since the COVID pandemic.

US investment-grade corporate bonds delivered positive total returns and outperformed duration-equivalent Treasuries, led by financials, industrials, and utilities. High-yield bonds also posted gains; higher-quality segments outperformed, as BB rated bonds led B and CCC rated bonds. Sector performance favored midstream, oil‑field services, and chemicals, while packaging, technology, and paper lagged. Global credit outperformed duration-equivalent government bonds as spreads tightened, with positive excess returns across US dollar, euro, and sterling markets. In EM, local‑currency debt outpaced external debt in US-dollar terms, supported by currency appreciation and favorable rate moves, while rising US Treasury yields weighed on returns. Securitized assets, including agency mortgage-backed, commercial mortgage-backed, and asset-backed securities also outperformed duration‑equivalent government bonds.

Currencies

The US dollar weakened against G10 peers amid elevated geopolitical tensions. Higher-beta currencies, such as the Norwegian krone, New Zealand dollar, Australian dollar, and Swedish krona, led the gains. The Japanese yen also appreciated versus the US dollar, following speculation that Japan and the US intervened to stem the yen’s persistent weakness. EM currencies ended broadly higher against the US dollar. High-carry Latin American currencies such as the Brazilian real, Mexican peso, and Chilean peso outperformed, helped by higher commodity prices and improving economic outlooks. The Malaysian ringgit was supported by favorable interest-rate differentials and positive domestic economic fundamentals. In contrast, the Indian rupee and Turkish lira depreciated against the US dollar.

Commodities

Commodities rallied (+9.8%) in January, with all four sectors contributing to performance.

Energy (+17.2%) surged, with natural gas (+40.5%) reaching its highest level in three years as winter storm Fern boosted heating demand and caused significant production freezes. Although output fell due to wellhead freeze‑offs, the decline was partially offset by a decrease in LNG exports. Heating oil (+20.2%), gas oil (+18.6%), crude oil (+14.8%), and gasoline (+11.9%) also recorded outsized gains due to increased US military presence in the Middle East and ongoing concerns regarding potential military action against Iran. US production disruptions caused by winter storm Fern also supported prices. Furthermore, data released by the US Energy Information Administration indicated a decline in US crude oil inventories, which was attributed to reduced imports and increased exports.

Industrial metals (+5.6%) rose during the month. Zinc (+9.6%) reached its highest levels in years amid tight supplies; London Metal Exchange inventories were low in Western markets reflecting ongoing smelter disruptions and a geographic supply imbalance caused by a large concentration of excess metal supplies in China. Nickel (+7.5%) rose on concerns over insufficient nickel ore supply from Indonesia relative to expected industrial demand. Copper (+5.7%) was buoyed by greater demand for hard assets amid the recent weakness in the US dollar and elevated geopolitical tensions, with additional support from speculative inflows and AI-driven demand. Aluminum (+5.2%) gained on elevated global inventories, uncertainty regarding new smelting capacity (particularly in Indonesia), and strong demand from electric vehicles and electrical grid expansion. Lead (-0.7%) ended lower due to weak battery-sector demand and high inventories.

Precious metals (+9.1%) rallied despite significant volatility during the month. Silver (+11.6%) and gold (+8.8%) continued to climb as broader geopolitical uncertainty, policy‑related risk premia, and a weaker US dollar sustained the demand for perceived safe‑haven assets and pushed both metals to record highs.

Agriculture & livestock (+0.6%) rose. Despite ample global stocks, wheat (+6.3%) ended higher as farmers opted to delay sales due to depressed price levels, tightening near‑term availability. Feeder cattle (+4.6%) gained as packers competed for limited supplies. Additionally, forecasts showed a further decline in feeder stocks due to a historically low number of cattle and slow herd rebuilding. Lean hogs (+4.2%) increased on reduced slaughter and circulating diseases in the US that threatened to curtail pork production. Despite lower Brazilian exports, coffee (-4.5%) declined due an improved supply outlook in Brazil, increased production forecasts, strong Vietnamese robusta exports, and higher inventories. Sugar (-4.7%) slid as higher production in India and Brazil and a potential increase in exports from India lifted expectations for a global surplus. Cocoa (-31.1%) plunged due to ample global supplies, weak demand, surplus forecasts, and good growing conditions in West Africa. Prices were also weighed down by less chocolate consumption, reflected in reduced cocoa grindings in Europe and Asia, along with declining sales from top producers.

Quarterly Market Review — 4Q2025

A monthly update on equity, fixed income, currency, and commodity markets.

By