How are investment-grade private credit deals sourced?

Deal access in the investment-grade private credit market is mainly driven by long-standing relationships, similar to other parts of private credit. But unlike traditional private credit, for those with access, deal sourcing may occur across a number of different channels, including the broadly agented market, club/narrow syndications, and direct origination. Club and directly originated transactions offer further diversification, as well as potential structuring and relative value benefits, but participation in these deals often requires specific relationships and structuring expertise. It is important to note that agents do not assist with the credit underwriting process, as is the case with bank loans. Instead, they act purely as intermediaries, bringing issuers and investors together to complete the transaction. This makes credit underwriting expertise across sectors and through multiple credit cycles particularly important in this market.

We believe it is advantageous to have access to each of these channels, as it increases the investable opportunity set, which can be particularly important in periods when illiquidity premiums are compressed or supply declines. For example, in 2020, the agented market was compelling as public markets took a step back and illiquidity premiums were high. Conversely, 2021 was a strong time for club/direct origination.

Is there liquidity?

Though the investment-grade private credit market is traditionally viewed as a buy-and-hold asset class with most of the transactions occurring in the primary market, a secondary market does exist. The overall market experiences approximately US$100 billion annual issuance, on average, with US$2 – 3 billion of that volume occurring in the secondary market.3

Given valuations are not publicly available in this market, an investor’s ability to transact may be tied to their access to pricing information. We’ve partnered with two of the largest secondary trading platforms to value and provide additional insight into pricing and liquidity trends in the market. In addition to liquidity for individual deal transactions, portfolio liquidation events may also occur in the secondary market, as evidenced by the two examples below.4

- Example 1: An institutional asset owner sought to sell US$ 500 million of securities five days before a US holiday. A leading independent valuation provider previewed the portfolio with a handful of investors and was able to sell 62% of the portfolio in three days, 83% by week four, and 100% by week 10. Despite the higher-than-typical volume and the relatively short timeframe, more than 50% of the transactions were executed at the prior month’s valuation level, and the average variance across the transactions was less than 5 bps.

- Example 2: Another leading independent valuation provider was asked to assist with a liquidity exercise, which would require them to complete the entire transaction in approximately two weeks. They were able to execute 13 trades on day one across multiple buyers (~5) and finalized the remaining transaction before the end of the month. The average bid/ask spread was less than one basis point (although structured and distressed securities cleared above these levels).

Notably, investment managers with the ability to offer an open-end fund may also provide regular liquidity through periodic redemptions, natural liquidity via cash flows, and/or diversified portfolio construction (such as amortizing transactions and/or laddering of maturities).

How are securities priced in this market?

Consistent with public fixed income securities, investment-grade private credit investments are priced using the underlying treasury rate and appropriate credit spread, with an additional illiquidity premium component to reflect the less liquid nature of the asset class. The pricing is typically calculated via a yield analysis methodology, which involves using similar debt instruments (tenor, rating, etc.) to arrive at the appropriate illiquidity premium.

Wellington relies on two leading independent valuation providers to assist in our pricing efforts. Our arm’s-length valuation approach helps us gain comfort with the validity of our pricing data, given their access to the broad market, although we also employ our own internal oversight process as an additional risk lens.

How are institutional investors accessing investment-grade private credit?

Historically, US insurers have been the primary buyers of investment-grade private credit assets. For regulatory charge reasons and due to their desire for portfolio customization, these asset owners have preferred separately managed accounts when outsourcing the management responsibilities. Importantly, as new investor types have increasingly participated in the market, we have seen interest in both separately managed accounts and commingled vehicles, depending on the asset owner’s objectives and requirements.

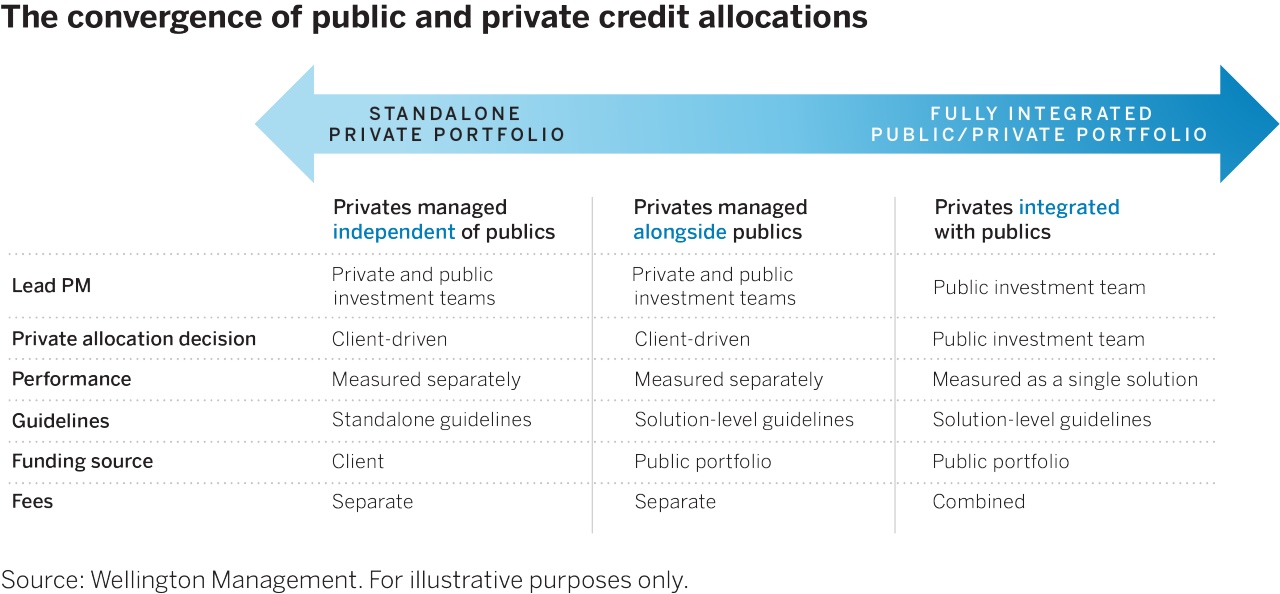

In addition, asset owners are consistently seeking a more holistic approach to their public and private credit exposures. Across client types, this is increasingly leading to the convergence of public and private credit allocations. While the implementation of the solution may differ, the most common drivers for an integrated public/private portfolio include more 1) consistent objectives and guidelines, 2) efficient capital management, and 3) controlled diversification.

Figure 2 shows our framework for evaluating and meeting asset owners’ unique objectives across public and private credit markets.