As markets start to adjust to a new economic era, divergence between economic blocs around the world is fast becoming a reality — creating a rich seam of opportunities in Europe for fixed income investors.

The developments driving this strategic realignment include:

- Policy shifts, including US President Donald Trump’s America First Agenda, which are forcing leaders around the world to radically reassess their policies and institute decisive change.

- A transformational response from Europe and growing recognition among policymakers that further action is required to address deglobalisation and maintain competitiveness.

Positive potential for European credit markets

We see significant implications for bond investors, with European investment-grade and high-yield credit markets likely to be the key beneficiaries. To date, the market impact has been most visible in equities, with European markets benefiting from increased flows, but we believe credit is next in line, offering, in our view, a compelling opportunity set for investors able to take advantage of these changing dynamics.

Regime change

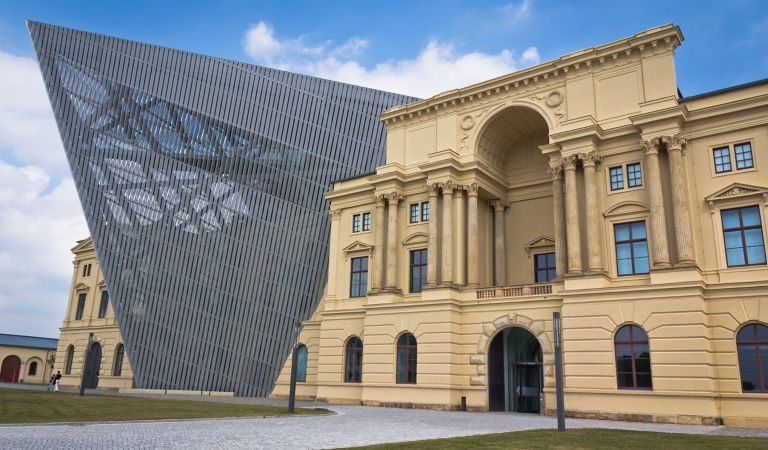

Europe is rapidly becoming more domestically focused and interventionist as illustrated by Germany’s transformational fiscal stimulus and Europe’s concerted efforts to raise its defence spending. Alongside this pivot, a broader push towards deregulation is emerging, aimed at unlocking domestic growth, enhancing strategic resilience and enabling Europe to compete more effectively in a rapidly evolving global landscape.

Together, these initiatives mark a notable departure from Europe’s traditionally conservative fiscal stance, pointing to a regime change that will undoubtedly define the region’s future economic path. We believe this is likely to support growth, enhance productivity and bolster Europe’s global positioning — both in terms of trade relationships and its attractiveness to international capital.

However, the path ahead is unlikely to be straightforward with a potentially fractious geopolitical environment and the need for policymakers to address longer-term issues such as government debt sustainability amidst flatlining growth, slowing productivity gains and ageing populations.

With that in mind, we think investors should prepare for potential bouts of heightened volatility as well as higher levels of dispersion between different issuers, sectors and markets.

That said, we see the existential threat faced by Europe as a powerful driver of reform, with the unfolding regime change now developing its own momentum. In our view, this structural transition could significantly enhance the opportunity set in European fixed income and recalibrate demand across global fixed income markets. Moreover, history suggests that fundamental change creates opportunities to generate alpha for active investors who are able to exploit ongoing market volatility.

Deepening markets

Regime change and shifting investor demand are coinciding with the reshaping of European fixed income markets. Since the European debt crisis of the early 2010s, we have seen an evolution towards deeper markets, greater diversification and improved credit quality that is now gathering pace.

Specifically, we expect the long-term tailwinds of European policy in areas such as infrastructure, defence, energy security and digitalisation to catalyse increased corporate issuance, as companies seek to align with public investment priorities.

Another notable trend is the rising presence of global issuers in the euro-denominated credit markets — a trend we’re seeing in investment-grade markets. Global companies with European operations are increasingly tapping local markets to diversify funding sources and benefit from more favourable all-in costs. This growing international participation is helping to deepen liquidity and broaden the investable universe.

These developments are enriching the opportunity set for both investment-grade and high-yield investors. They are also likely to bring greater dispersion across sectors and issuers, creating attractive opportunities for long-term alpha generation.

Favourable demand dynamics

The demand backdrop for European credit is also evolving. Since the global financial crisis, portfolios have been structurally tilted towards US assets, but this strategic overweight is now coming under intensified scrutiny amid ongoing US dollar weakness and growing concerns about US Treasuries’ safe-haven status.

Notably, we think European credit is positioned to benefit from greater interest from global investors seeking diversification and attractive hedged yields relative to domestic bonds. Additionally, European credit is increasingly comparing favourably to US fixed income assets, especially as investors contend with the hedging costs associated with a weakening US dollar. At the same time, tariffs and the push for higher domestic investment may reduce the European capital surpluses historically invested abroad, potentially further deepening the pool of capital deployed in European fixed income markets.

Importantly, we believe European yields are likely to remain relatively elevated, supported by a combination of fiscal expansion and a more resilient growth outlook. This environment should continue to attract yield-motivated buyers, providing technical support across credit markets.

Making the most of the widening opportunity set

We believe the combination of historically attractive yields, robust and diversified demand, and the potential for credit spreads to remain anchored creates a strong case for total return and income generation through euro-denominated credit.

For both investment-grade and high-yield investors, we believe changing market dynamics will support long-term returns. At the same time, the inherent volatility that typically comes with regime change underscores the importance of an active approach.

For investment-grade investors, we think the current environment offers an attractive mix of strong corporate fundamentals, robust technical support and still elevated yields. We believe that the credit cycle remains robust but that we will see greater volatility. These episodic bouts of volatility, coupled with an increase in sector, country and issuer dispersion, are creating significant scope for mispricing that can be exploited through security selection. Regime change, with its more interventionist policies, greater domestic orientation and fiscal support for key sectors, will not only further diversify an already rich opportunity set but may also provide further alpha potential.

For high-yield investors, the combination of attractive yields and a structurally short-duration profile makes European high-yield bonds especially appealing for investors seeking to manage interest-rate risk or reduce equity exposure. Today’s European high-yield market has seen an increase in quality since the European debt crisis, and fundamentals remain solid. We expect defaults to stay close to historical norms, as much of the riskier lending has shifted to the private credit and leveraged loan markets. In our view, this creates a favourable return backdrop for European high yield relative to other regions, particularly when combined with an accommodative macro backdrop.