Emerging yellow flags?

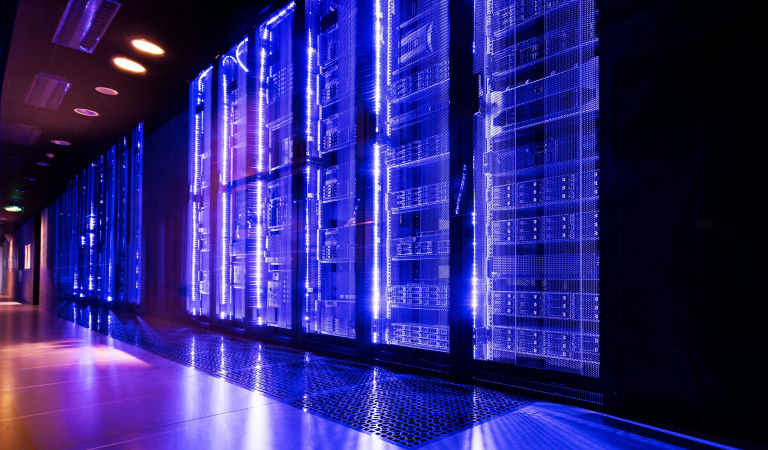

The pace of AI capital investment is picking up dramatically based on company announcements about new data centers and other developments, and stocks are still tending to rise meaningfully on the news even though cash flows are not as strong as before. As the scale of the build-out grows, we are seeing a transition toward debt financing, with vendor financing starting to become visible as well, in order to sustain sales. In addition, finance leases are being added to expand data center capacity, but they are not included in the capex intentions of these companies, suggesting that the capex numbers are undercounting the strength of the build-out. Undercounting could raise the risk of overbuilding and creating excess supply (an issue that arose during some previous technological breakthroughs, including railways and the internet).

Another potential yellow flag: Rising stock prices are being used to conduct deals, and there is evidence of the companies involved in the deals buying each other’s products. In the past, deals like this have proven to be important signals to stay vigilant about whether future return expectations will materialize in the stated time frame.

The role of private equity and credit in funding the AI technology diffusion is also something to watch, given the potential of such investments to account for a large share of those asset classes. With less public information available around deals in this space, judging the quality of underwriting and whether lending standards are eroding will be critical.

Finally, the US backdrop of an interventionist government should be monitored. While AI may displace white collar workers and slow wage growth, immigration restrictions could mean that industries reliant on low-skill workers will face rising wage pressure as growth improves across the broader economy. In addition, while the Trump administration is pro AI, its stance on skilled talent from overseas could hinder AI adoption.

The contrast between the current government backdrop and what we witnessed in the tech revolution of the 1990s is stark. Back then, the US was encouraging globalization, free trade, and immigration. Today, we’re seeing the opposite, and the current policies could interrupt the virtuous cycle of higher investment spending and productivity that has captured the market’s attention. This key risk/tension should be on investors’ radar.

Final thoughts

Clearly, a great deal is riding on the future of AI, from both an economic and a market standpoint. Looking through a historical lens, I think there are strong reasons for excitement about the promise of this era of innovation. At the same time, the benefits for productivity and growth will not emerge overnight, and there may be policy- or macro-driven bumps along the way, suggesting that patience and a long-term perspective will serve investors well.