The Federal Reserve (Fed) has been on hold this year, making its last cut in December 2024, citing inflation risks tied to tariffs and policy uncertainty since then. Globally, developed markets have largely pressed forward continuing to cut rates. However, it appears the Fed may not be far behind, acknowledging that addressing potential cracks in the job market may take precedence over inflation, which tariffs have yet to accelerate.

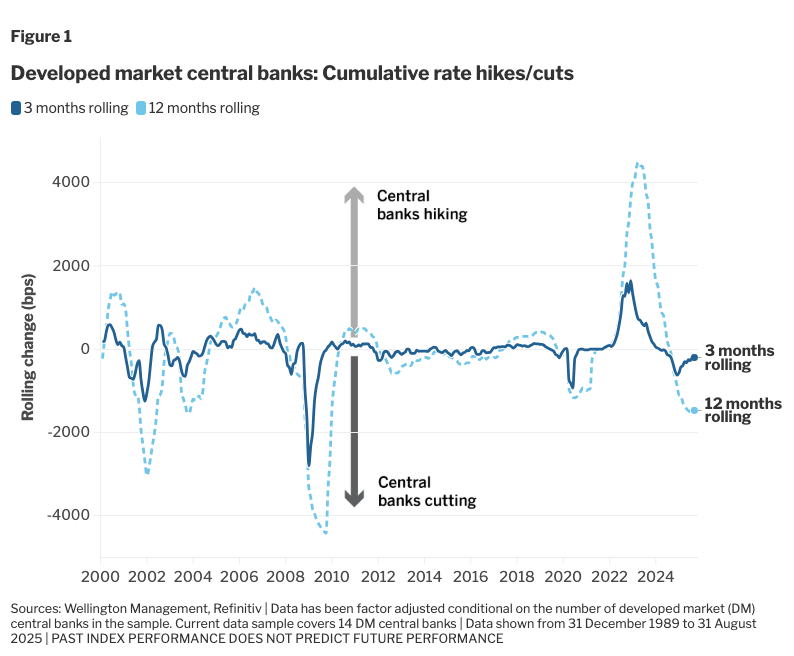

The chart highlights the magnitude of cumulative rate hikes across developed markets to address pandemic-related inflation, as well as the subsequent scale of rate cuts currently underway to restore normalcy. With inflation having receded over the last couple of years, cuts have been aiming to move rates from a restrictive stance to a neutral stance — meaning to reach a level at which they are neither restrictive nor stimulative. More recently (rolling 3-month data), cuts have slowed, suggesting central banks are waiting to assess the impact of US tariff policy and other upside risks to inflation.

Historically, developed market central banks have largely moved in tandem with the Fed. However, complex dynamics such as tariff policy, aggressive fiscal global stimulus, and political interference with central banks could fracture this alignment, leading to potential policy divergence and disruption of cutting paths.